Businesses can use many methods to improve their profitability—all of which require tracking operational performance rigorously. The fact is that increasing profit does not happen without paying attention to business metrics. The right business metrics not only help you accomplish your business objectives but will also help you know what areas are exceeding expectations and the areas that are falling short.

Because there are various kinds of businesses with many functional areas and departments, there are hundreds of unique business metrics. With this in mind, selecting the ones that matter most to your specific business is vital.

Molly Alter, Partner at Index Ventures, reveals the most important metrics that business leaders must understand.

How fast should I be growing?

Growth is vital to the long-term survival of any business. But in reality, it’s tough to do benchmarks around growth. Investors have different expectations, and the growth rate should be anticipated with the broader picture of the company in mind.

First, it’s important to emphasize Net New ARR. This metric differentiates a company that’s growing linearly from a company that’s accelerating. If Net New ARR grows from 10 million to 15 million to 20 million, that’s a linear growth trajectory. However, if your Net New ARR grows from 5 million to 10 million to 20 million, then your company is accelerating. You can set yourself apart as a metrics-driven entrepreneur by showing your Net New ARR numbers when you try to fundraise.

“It’s not just the metrics that matter. It’s your command and control that make the real difference.”

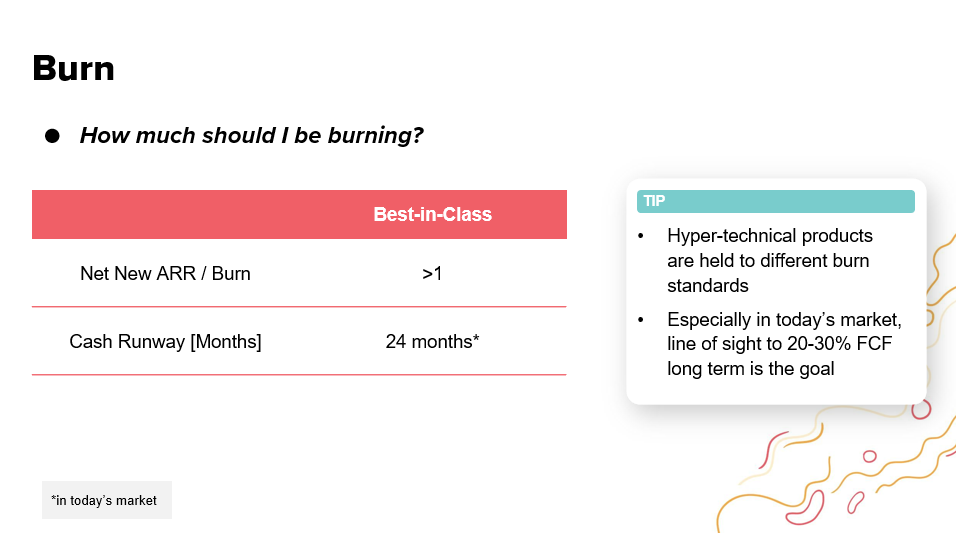

How much should I be burning?

Burn rate refers to the pace at which a business spends money. One of the most interesting metrics to track with burn is your Net New ARR divided by your burn. In most cases, a result that’s around one is good.

Another important metric to monitor is the cash runway, how much longer a business can operate at a loss before running out of money. If your cash runway keeps diminishing, that’s a red flag and should signal you to cut down on expenses or figure out a way to generate more revenue.

“It’s advisable to extend the cash runway to 24 months, giving the business enough time to ride out different market fluctuations and continue to grow.”

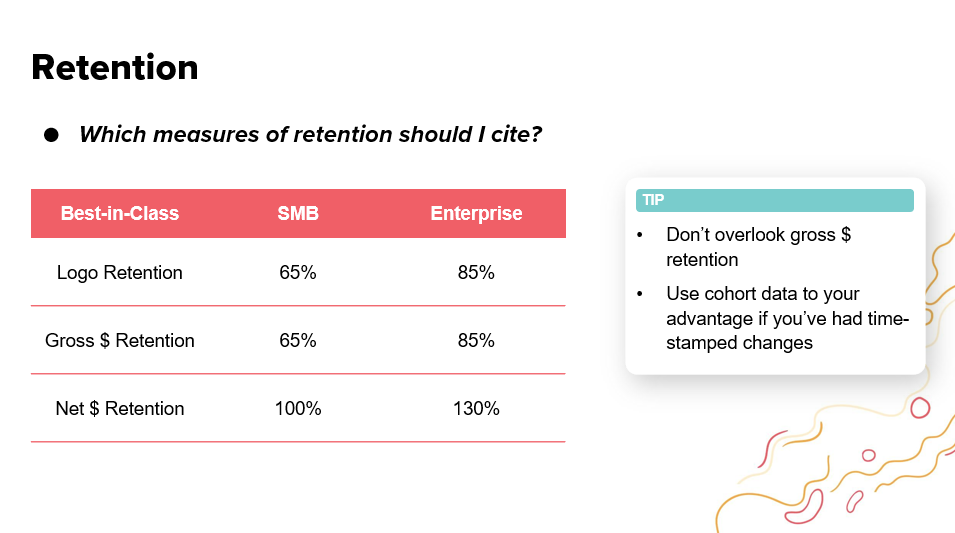

Which measures of retention should I cite?

Retention metrics are an essential component of long-term business growth. Customer retention makes your business financially successful in the long term. The following three retention metrics are worth tracking and measuring: logo retention, gross dollar retention, and net dollar retention.

- Logo retention is the percentage of customers a business retains over a period of time. It’s a fundamental metric to understand how great a business is at keeping its existing customer base, so a poor logo retention rate could show potential customer churn problems.

- Gross dollar retention is the percentage of a customer’s revenue that has remained with the business after a year. It’s a metric that analyzes changes in recurring revenue induced by movements in existing customer revenue.

- Net dollar retention is a metric used to make year-over-year performance evaluations. This metric estimates the percentage of recurring income from current clients that are retained.

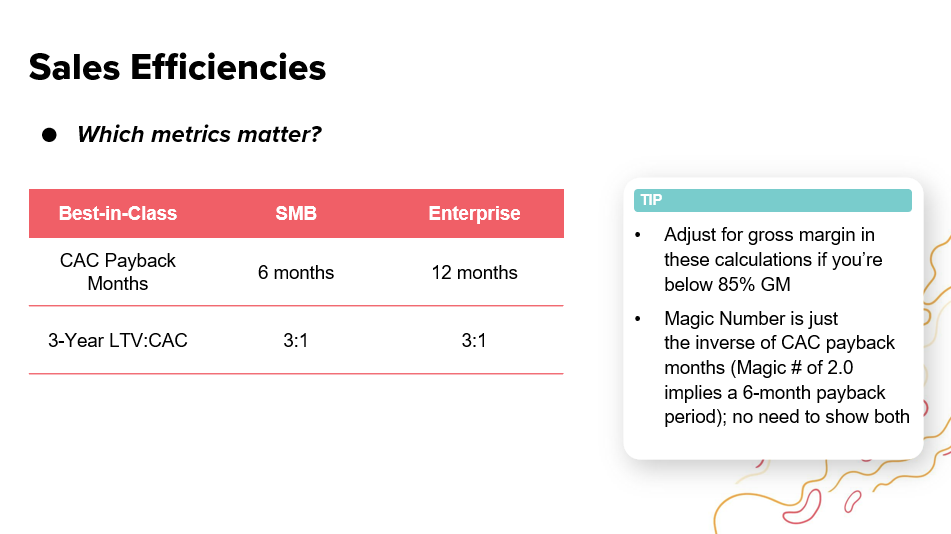

Which metrics do matter in sales efficiency?

It’s important for businesses to make sure that they understand the lifetime value (LTV) of their customers and the cost that it takes to acquire them. There’re a lot of metrics around sales efficiencies, but the two most important ones are the customer acquisition cost (CAC) payback period in months and the three-year LTV/CAC.

- The CAC payback period in months is the metric that measures the time it takes a business to earn back its spending on new customer acquisitions. This metric determines the amount of cash necessary for a company to fund its growth strategies. Yet, the CAC payback period in months is only one part of the equation.

- The ratio of LTV to CAC helps you see how much you have to spend on acquiring a customer. Measuring this ratio will reveal if you’re overspending per customer or missing opportunities from not spending enough.

What about everything else?

Other metrics to pay attention to include gross margin, net promoter score (NPS), and annual contract value (ACV). These metrics are helpful, especially with other metrics such as CAC.

- Gross margin is the percentage of a business’s revenue that it keeps after deducting direct expenses.

- The net promoter score can be used as a predictor of business growth. When the company’s NPS score is high, the company has a healthy relationship with its customers, who are likely to generate a positive growth cycle. Although NPS is a valuable and strategic metric, it isn’t enough by itself to show a holistic picture.

- The annual contract value shows how much an ongoing customer contract is worth by averaging and normalizing its value over one year.

Key takeaways

- All metrics are interconnected, and some can supercharge more than others.

- Strong metrics typically reflect some sort of unfair advantage.

- No business has perfect metrics. But knowing where and how you can improve these metrics fall within your control.