Founder and CEO of SaaStr Jason Lemkin deep dives into the current state of SaaS and the Cloud.

Lemkin and David Sacks touched on whether SaaS is making a cautious recovery, and Lemkin shares a slightly different perspective here.

A Cautious Recovery?

Sacks and Lemkin have slightly different views on whether we’re experiencing a cautious recovery.

Lemkin believes we are absolutely in a cautious recovery in SaaS, and folks should be modestly bullish today.

Unemployment is 2.8%, which would be the weirdest downturn or recession in the world with the economy fully employed.

Instead of viewing it as a recession, it’s more of a shock.

Everyone spent way too much money in 2021. The markets and buyers were crazy. Zoom went from $1B to $4B, and they can’t climb all the way to $256B.

So there had to be a shock.

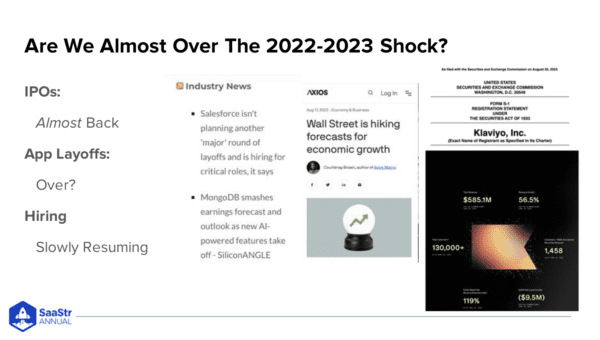

A few things happened on the B2B side that show a cautious recovery…

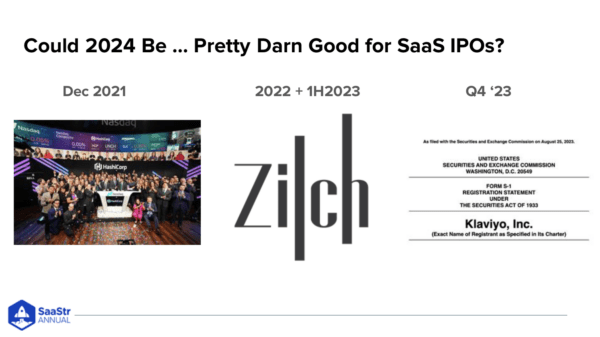

- Klaviyo filed its S1 — the first great SaaS IPO since December of 2021 at $650M in ARR, growing almost 60% and profitable.

- Lemkin believes both people and app layoffs are over.

App Layoffs Were Brutal, And Hiring Is Slowly Resuming

If you haven’t worked in Fortune 500 or tech companies, you’ve never seen this.

What happened was everyone got more conservative in 2022, cutting back on spend. All VPs gather in a room and go around the table, sharing apps and people to get rid of.

The reality is there was an explosion in sales and marketing and other categories in 2021 when the goal was to grow, grow, grow.

So, the excess people and apps got cut after the belt tightened.

Salesforce and almost every leader did some form of layoffs to get fit and more efficient.

But now they’re done.

Salesforce said they aren’t doing any more layoffs, and they’re actually doing critical hires now.

It’ll never be like 2021, but outside of spot issues for leaders, hiring is slowly resuming.

The Heavily Impacted, Not Impacted, and Mildly Impacted

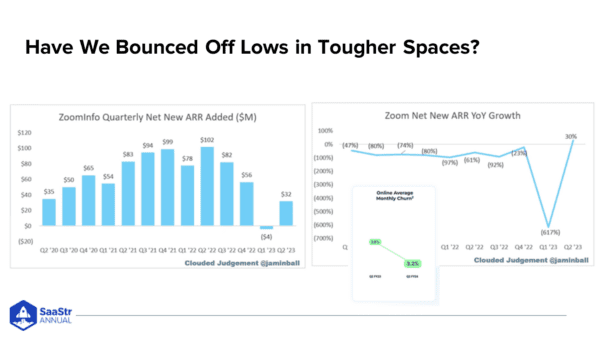

Zoominfo is a hero company, bootstrapped to a billion-something in revenue and profitable every year. They’re a public pure-play leader in sales and marketing.

Why are they included here?

Because if you’re in sales and marketing, you’re probably a little like them.

If they’re booming, you should be growing. If they’re struggling, you’re probably struggling too.

This chart for net new ARR peaked in Q2 of 2022. Then boom! All the way down, and Q1 of 2023 was tough.

But it bounced back.

Folks have different low points, but most everyone experienced it around the first or second quarter of this year before bouncing off the bottom.

They aren’t back to the go-go-go days, but it’s better than it was.

And then you have Zoom on the right.

Zoom is crazy. They never intended to grow the way they did during the pandemic. It couldn’t last, so they had the biggest overhang.

Before March 2020, it was almost the only single-seat SaaS product with over 100% NRR. It doesn’t happen that way.

People loved Zoom and didn’t churn.

Then everyone in the world was on Zoom selling flowers and yoga and things meant to be sold in person, so churn peaked at 3.6%, which isn’t terrible for SMB, but was higher than none.

In the last quarter, they re-accelerated since the previous 18-24 months. Is it epic, and will it return to triple-digit growth? No, it’s too mature, but it’s back.

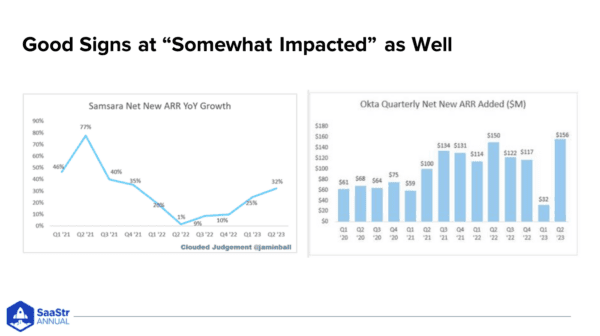

The somewhat impacted examples are Samsara and Okta.

Samsara is a quiet but big vertical, and they hit a low point earlier than ZoomInfo in Q2 of 2022. They came down to Earth from high flyer growth but are slowly re-accelerating over the last four quarters.

Okta is a market leader in identity and app management, and they’re a derivative of everything happening in Cloud and SaaS spend. This is a CIO purchase, and Okta bookings didn’t go to zero but hit the biggest impact in Q1 of 2023 and boomed in Q2 of last quarter.

It was by a smidge, but they had the highest new bookings on record.

Toast and Monday are included as more of a challenge to folks that not every category is impacted because it’s not a recession, depression, or downturn.

Areas were impacted, and layoffs hurt individual vendors, but the U.S. economy is a global powerhouse right now.

Unemployment is at an all-time low, and the economy is humming.

If you look at SaaS companies that sell to the real world and not just to other tech, they didn’t miss a beat.

Toast had a little impact but also just had a record quarter. Monday saw seat contraction but didn’t miss a beat because only 30% is to tech, and 70% is to normal businesses.

It’ll take another 20 years to see another bubble, but times are pretty good, even if they don’t feel like it.

Almost everyone is doing better than a year ago.

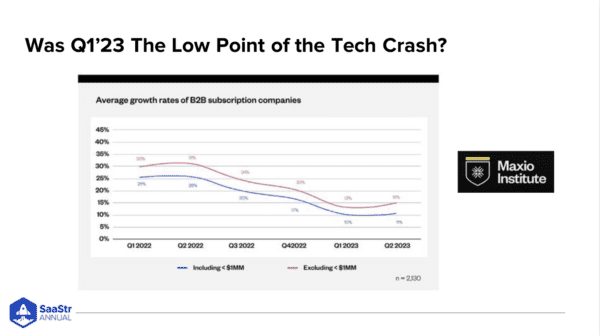

Was Q1 the Low Point of the Tech Crash?

This is more of a look at startups. If you squint, you can see in Q2 a little bit of the first re-acceleration in 5-6 quarters.

It’s not epic like 2021, but you can see a turn-up in overall growth across all their customers.

Everyone is coming off lows. It’s possible to crash in a few quarters if the Fed raises interest rates, but the core plans have to assume things are better.

How Efficient Of A World Are We Going Back To

As founders, you should do everything humanly possible to have no non-performance layoffs.

We have recurring revenue and should predict the next quarter or two.

With Monday, which happened with so many leaders, they hit headwinds, and NRR went from epic to pretty good.

So, they slowed hiring and did a small layoff of underperformers.

They grew headcount fairly aggressively from ‘21 to ‘22, and then Q4 of last year dipped and held flat before starting to regrow.

Monday will probably add 25% headcount this year.

Salesforce is back to hiring.

Monday went from cash flow negative to very cash flow positive in five quarters.

So now we’re at the meta question of how much companies will loosen the belt now that we’ve passed that low earlier this year.

How efficient a world are we going back to?

For the first time in many years, the average revenue per public SaaS company is over $300k — a critical ratio for efficiency of how much revenue per employee.

$300k is the most efficient anyone has been in recent memory.

So, how efficient do we have to be now?

We’ve gotten used to certain types of sales compensation, certain levels of Customer Success, and certain types of coverage and marketing spend.

We’ll never go back to 2021, so can we go back to 2019 or 2018?

We’ll see.

Two Conflicting Trends

Everyone has learned to become more efficient and could hold off on profitability.

Look at Monday. They grew so fast!

In 2017, they were at $7M ARR, and now they’re at $700M ARR. If you burned a little cash, it wasn’t the end of the world.

But now they’re epically efficient. So is MongoDB and Salesforce.

Everyone will have to work harder, sell more, and close more for the same dollar and compensation, and they’ll have to part ways with folks who aren’t efficient enough.

The good times are coming back, though.

VCs will get excited about Klaviyo. It’ll be a monster IPO and probably trade over $10B. There’s nothing not to like other than the fact that they’re 70% dependent on Shopify.

If you look at it, Klaviyo is epic, but so many good companies are waiting to go public — Rippling, Databricks, Gusto, Greenhouse, and SalesOp.

They’re all at $200M and will probably all IPO next year.

It’s a timing question, and if Klaviyo does well, the back half of 2024 should be full of good companies. Most are probably cash-flow positive today.

There is one big caveat…

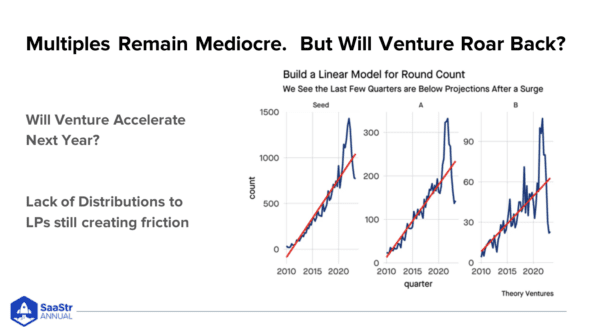

Multiples Aren’t Great In Public Markets

Multiples aren’t going to 20x or 40x. They’re worse than they were 5-6 months ago.

So be thoughtful and humble about valuations and capital raises because multiples are the one hitch.

Great companies are waiting to IPO, but multiples are mediocre, and that’s the quiet drag that will make things harder.

Venture will be tougher, and later rounds will become harder.

To Summarize The State Of SaaS Today

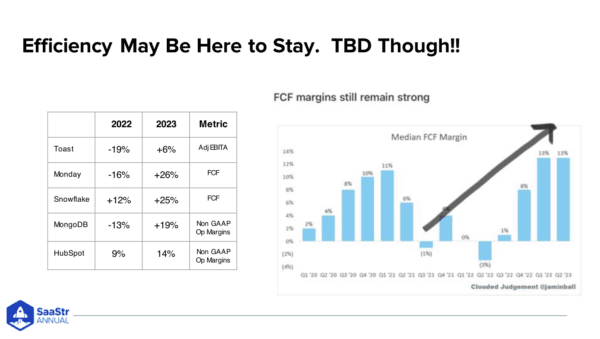

If you look at the slide on the left, you’ll see how much more efficient these huge companies have become.

Toast went from -19 to +6. Monday: -16 to +26. Snowflake doubled free cash flow. Mongo went from -13 to +19.

Everyone has gotten much fitter, which will be a fundamental change to how we think and build startups.

Lemkin’s advice is to do better than last year.

Your customers are not doing worse than 2-3 quarters ago. It’s not hard to sell sales automation tools, sales analytics, or marketing analytics.

“Pick yourself up off the ground and do better than last year,” he says.

He’s not saying you’ll go from 10% to 180% growth in one year, but you can challenge yourself next quarter to do better than last quarter and better than 12 months ago.

There’s no excuse. It’s not worse. It’s better.