Since the start of 2022, the focus of SaaS leaders has changed from growth at all costs to sustainable growth and being default alive. Often, leaders struggle to choose between increasing the runway for their companies and pursuing growth. But why not both?

Kristina Shen, General Partner at Andreessen Horowitz, joins Sean Jacobsohn and Scott Beechuk, Partners at Norwest Ventures, to discuss how to prioritize both successfully. Kristina shares how to manage your capital via burn management, and Sean and Scott provide their insights into alternative ways of achieving growth.

Burn management by stage and alternative metrics

The top quartile of publicly traded SaaS companies was trading at 24x revenue last year in October, and now it’s at 8x—one-third of what it used to be. What does that mean for early-stage SaaS?

Private markets look at the public market for guidance about valuation, and this statistic reflects a huge correction in SaaS valuation multiples. Whether raising your next round or aiming for an exit as your next financing event, plan your revenue ahead with realistic multiples and build an efficient business. Burn management is essentially solving for the next financing event for your company.

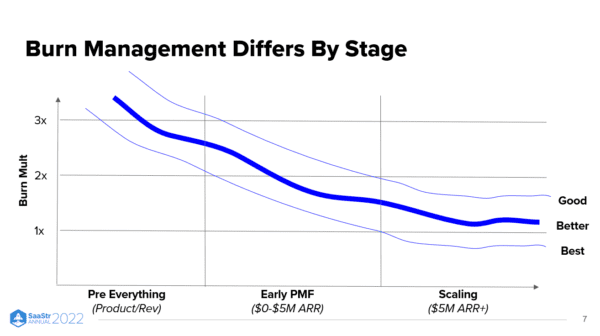

“Burn management is not one size fits all; instead, focus on burn management by stage.” — Kristina Shen

In pre-product and early product days, the burn multiple—the ratio of net capital burn to net new revenue—is a flawed metric to look at a company. You’re making the first few dollars of revenue; the ratio is fundamentally skewed.

David Sacks’ burn multiple charts work best for the next stage—when you’ve got the product and are finding PMF. Post PMF, when you start scaling your business, burn multiple is inflated due to R&D costs, a necessity for infrastructure and platform companies.

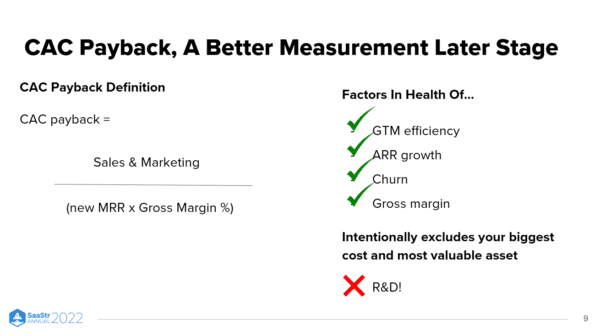

Instead, when scaling, look at CAC payback. It’s the monthly sales and marketing spend ratio to the net new monthly profit—new MRR multiplied by gross margin percentage. CAC payback factors in all the health indicators of your business: GTM efficiency, ARR growth, churn rates, and gross margin. It intentionally excluded R&D costs, understanding that it’s an investment for the future.

Unlock non-linear growth by leveraging partnerships

Partnerships make it easier to enter new markets and different niches. Entering uncharted waters is scary but more feasible with a partner, and it outflanks your competition. These partnerships could be:

- Segment-wise. Partnering to sell to SMBs while you’re an expert in selling to enterprises.

- Industry-wise. Partnering with leaders in industries where your product can have a use case.

- Geography-based. Partnering to sell in Europe, Latin America, or Asia with successful partners in those regions.

The best partnerships are where you extend the product offering of your partner. For example, Gusto’s payroll product is extended by its partner Guideline with its 401k product. Helping your partner sell their own product quickly will always win over sales commissions as the motivation to sell your product.

Enabling your partners to represent your brand successfully is as important as signing the partnership. Enabling isn’t a one-time exercise. You need to nurture that relationship just like your in-house talent as your product and market conditions evolve.

“At Cornerstone, we partnered with Ceridian in Canada. We enabled their sales, marketing, customer support, and implementation teams to sell on our behalf. It worked out so well that we didn’t need to have any other partner in Canada.” — Sean Jacobsohn

Reciprocation can get your foot in the door for ambitious partnerships. Instead of asking how you can partner with a big company to sell your product, ask how you can send leads their way. They will reciprocate and send business your way, starting a two-way referral-based setting that can grow into a reselling arrangement and a full-scale partnership. Partners are also the best source for M&A activity. An intimate relationship with potential buyers is the key to getting acquired, and no better way to build that relationship than a partnership.

To prevent potential conflict in your partnerships, avoid getting into too many of them, and no more than 10% of your revenue should come from a single partner.

DIY growth hacks to juice your sales

In a downturn, shift from “always be closing” to “everybody be closing” mindset. With all hands on deck, reach out to your customers, embrace them, and build deeper relationships. Because if you don’t, your competitors will. This approach will open up opportunities for expansions, upsells, and cross-sells in a market with low “new logo growth.” Why? Because most customers use only a percentage of what you’ve built and are unaware of the full functionality of your product.

That doesn’t mean you stop going toward new customers. In fact, this is the best time to get creative in your cold outreach to prospects. Every executive is overwhelmed with SaaS outreach emails, so you’ve got to stand out. Hunt down former customers who have changed jobs and taken on new roles. It’s easier to find more opportunities where you have already established trust.

PLG is the book move for growth in SaaS. The pure-play PLG model has three components:

- Give away nearly 100% of your product for free.

- Incentivize free users to invite other free users and build a flywheel to drive virality.

- Back up the system financially with enterprise sales.

Many SaaS businesses are not built for pure-play PLG but can leverage what Scott calls welterweight PLG.

- Turn on just enough features in your free trial to engage the users.

- Build a drip email campaign to highlight upgrade options.

- Equip your sales team with the usage data to reach out at the right moment and have intelligent conversations that lead to closing an enterprise deal.

The critical difference is the lack of the virality flywheel. Building that flywheel is an engineering and time-intensive process, and you can hack your way around PLG by skipping it.

“The key to sustainable growth is not spreading yourself too thin. Focus on the top 20-30% of customers you estimate are likely to close and put all your efforts behind them.” — Scott Beechuck

Takeaways

- Understand the root ROI of your spend.

- Invest early in partnerships to drive a multiplier effect in GTM.

- Focus is key. Creativity leads to doing less with more.