Underrated:

How great of a business model SaaS is. You can literally do almost nothing but make your customers happy and usually you will still grow.

Underestimated:

Just how expensive the incremental customer gets beyond your core, highest velocity ICP.

— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) February 20, 2023

So in the Boom Times of late 2020 through early 2022, all we talked about was Unicorns. 1,000+ Unicorns bloomed, hundreds of them in SaaS.

Ignored a bit was the cap table. To sustain those $1B+ valuations, startups often sold $100m+ of shares, as well as very large stakes in their startups. And realistically, cut off any potential M&A acquisition deals for even hundreds of millions of dollars.

And that’s just fine if you build the next Slack, Figma, Zoom, Databricks, Monday, Bill, etc.

But one thing no one talked about was how the power and magic in recurring revenue can make a $100,000,000 exit magical if you are capital efficient.

What do I mean?

Well, there aren’t that many acquisitions in general in SaaS, no matter how it looks on TechCrunch. There are only so many buyers out there. But there’s one deal that gets done pretty often: a SaaS leader that gets to about $20m ARR or so, with decent-but-not-great growth, and gets bought by a Private Equity or Bigger Tech Company for $100m+.

$20m ARR with 100%+ NRR and even just so-so growth gets a lot of folks interested in an acquisition as long as you are doing something reasonably important in SaaS.

Now it’s not always a huge multiple. A $20m ARR startup growing 40% getting acquired for $100m ARR isn’t an amazing outcome for VCs.

But if you are careful, and manage your cap table, you often can achieve it.

If you can get to $2m ARR, and you have happy customers, keep at it. Eventually, if you have a great team or even just a great set of co-founders, you can probably get to $20m ARR.

It might take you the better part of a decade, in some cases. And that will be slow, and painful, and you’ll lose folks on the way.

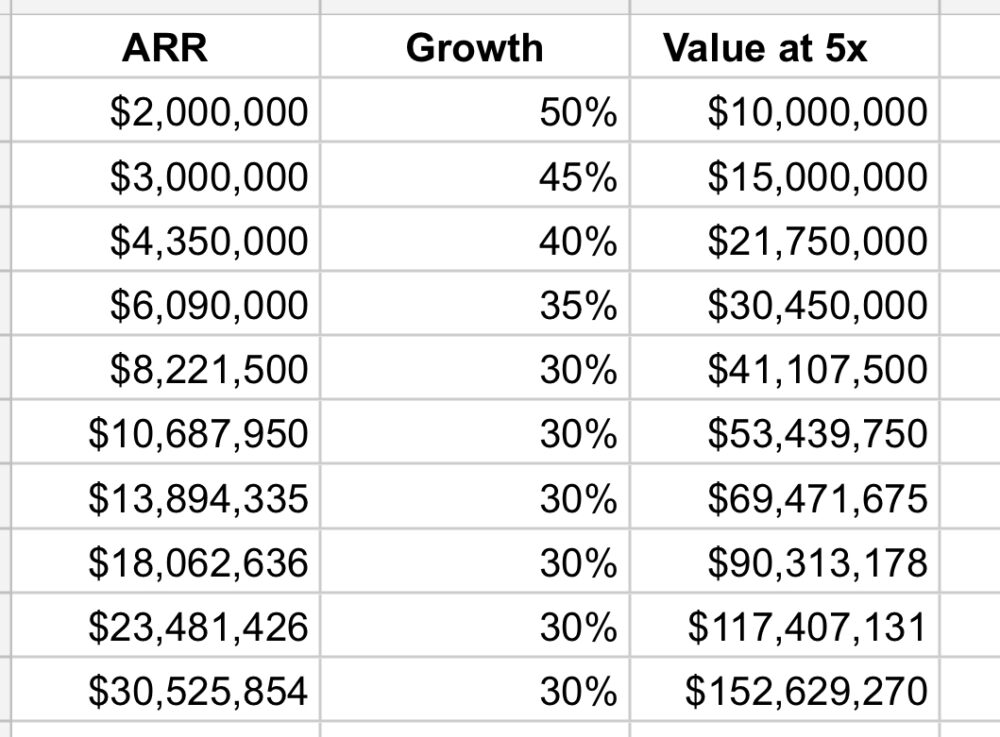

Take a look at this example of fairly slow, but steady, growth after $2m ARR:

SaaS is hard and hard to get going, yes. But it is real and permanent, if you do it right. If your NRR is over 100%, that’s a kind of magic if you invest in it.

By all means, build the next Figma if you can. But if you can’t, maybe don’t raise too much money. Get to $2m ARR, and keep growing and growing. Keep your customers happy.

And while it may take 5, 8, even 10 years, you should get to $20m+ ARR at least. Maybe more.

And usually, if you do something important, that’s worth $100,000,000 or more in SaaS.

A related post here:

(tortoise image from here)