After the early days — most. That’s just math.

Of course, it varies. But one thing that is almost always true, is you get more renewals, more upsells, and more net revenue retention from your largest customers.

- Squarespace is almost all not just SMB, but self-service. Their new revenue retention is about 85%.

- HubSpot is almost all small businesses, but at a higher price point ($10k) that is sold directly and through channel partners. As a best-of-breed player, its net revenue retention is about 100%.

- Shopify sells mainly to SMBs and is at about 100%, and driving to 110% as merchant services become stickier and stickier.

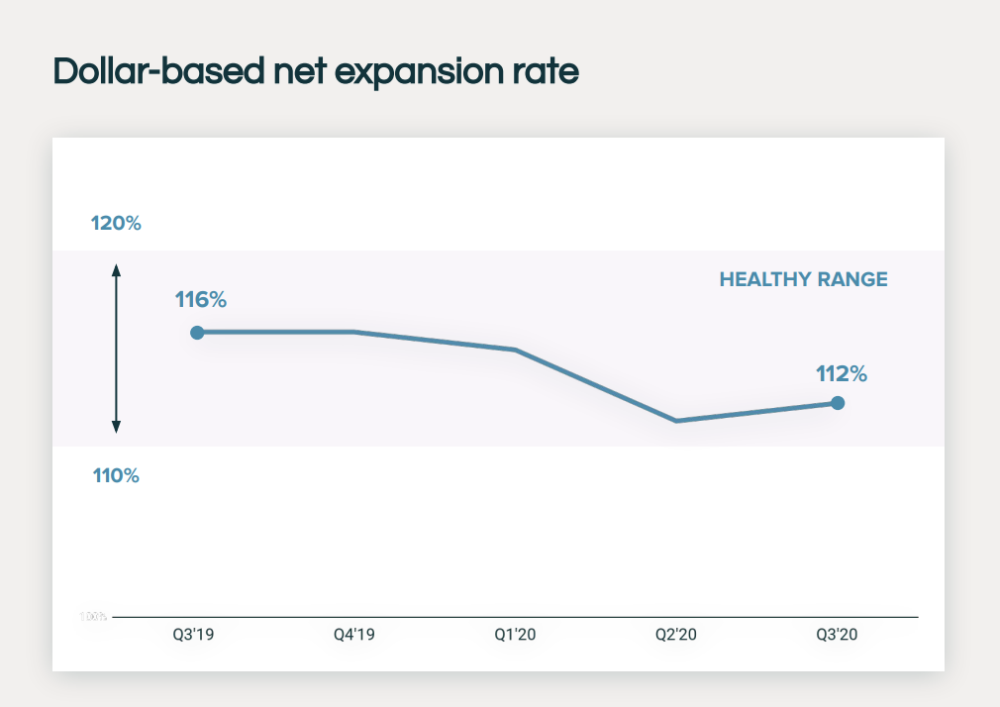

- Zendesk has a mix of customers at 120% at IPO, down a smidge to 116% after IPO and 112% after Covid:

- Box has small, medium and large customers. Its net revenue retention at IPO was about 130% and the majority of its new bookings come from its existing customers.

- Twilio was 150% at IPO and is still at 140% today.

- Today, 73% of Salesforce’s new bookings come from its installed base.

More here: Public SaaS Company Disclosure Metrics for Retention and Renewal Rates

So …

If you are selling mainly to small businesses, roughly, 80% net revenue retention is good, 90% is strong, 95% is Best of Breed.

If you are selling to enterprises, 130–140% net revenue retention is very strong.

For a blended model (S, M, and L), 120% is strong a la Zendesk.

Whatever it is, measure it. Segment it. Resource it.

And drive it up.

(note: an updated SaaStr Classic answer)