A great product, while necessary, isn’t sufficient to build a market leader and eventually a public company. Companies that win a market are just as good at Go-to-Market as they are at building great products.

General Partner Doug Pepper and General Partner and Head of Analytics at ICONIQ Growth, Christine Edmonds, share the art and science of scaling GTM at this year’s SaaStr Annual. With over a decade of data from qualitative learnings and insights amassed through a network of leaders, ICONIQ deep dives into what it takes to succeed at GTM throughout the four stages of growth.

The four stages of growth are:

- Early stage

- Early growth

- Growth

- Pre-IPO

Each of those stages has key GTM milestones, benchmarks, and team-building strategies that allow you to grow effectively. Go-to-Market matters because sales and marketing spend remain the biggest proportion of SaaS spend, so honing in on that spend to build an engine and drive growth is paramount.

The Early Stage — $0 to $20M ARR

The early stage is crucial for GTM. Without it, you don’t have a business. But to develop a GTM strategy, you must have Product Market Fit. Amazing product-oriented founders who truly understand the market and what products to build for the right ideal customers can then build a differentiated product and execute on a GTM strategy.

According to ICONIQ’s data, many successful companies hit a growth plateau at around $15M ARR.

Why?

Because founder-led sales worked really well for most of the early stages, but you eventually start running out of juice around $15M ARR. And especially with great products, there’s always pull from initial early adopters that runs out. The key is to start to build a GTM strategy that allows you to attack a larger market.

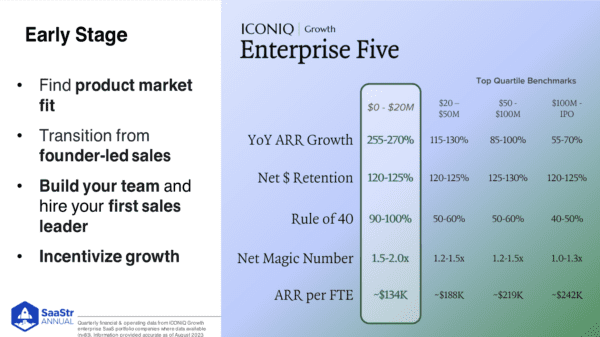

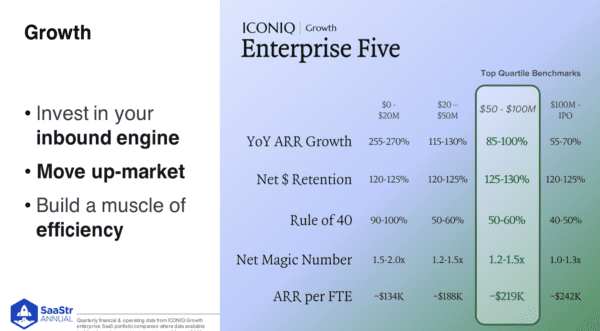

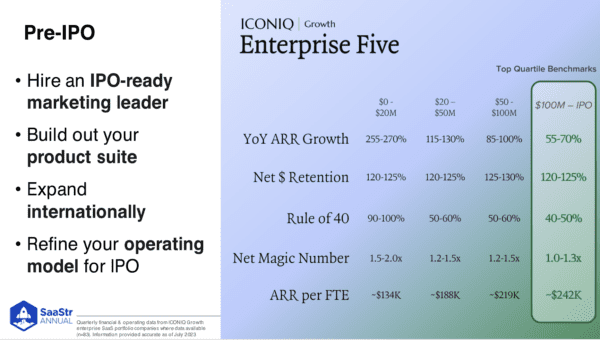

Those familiar with ICONIQ’s work will recognize the ICONIQ Growth Enterprise 5. While it’s not the focus of this article, it’s a frame of reference for performance across the different stages.

There are five metrics ICONIQ feels are indicative of fundamental health regardless of stage, and so, while each one may not be directly tied to GTM health, they are all indirectly tied to it.

What do these look like from an early-stage standpoint? This is the stage where best-in-class companies can double or triple revenue in the first few years of growth. From a strategic standpoint, early-stage companies start to build out their teams, transitioning from founder-led sales to incentivizing growth as they build those teams.

The Best Time to Make the First Few Hires

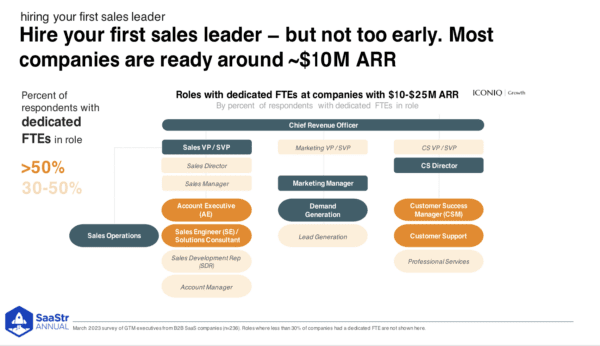

Typically, in this first stage of $10M ARR and below, it’s more common for companies to hire the first AE before the Head of Sales. Founders are still leading sales and are very good at it. They need to hear the customer and use that feedback to refine products.

Around the $10M mark is when many companies:

- Hire a Head of Sales

- Start to build out key hires on Customer Success and Marketing teams

- Start putting in the foundation of Sales Ops and demand gen

Your first Head of Sales might not be the person who takes you up through IPO. So, you have to be thoughtful about who you’re looking for.

Generally, most companies have 2-3 sales leaders between founding and going public. Right now, you want someone to take you from this early stage to the early growth stage.

The big questions to ask yourself when you’re sub-$20M and still relatively unknown are:

- Am I hiring someone who has previously had the title of Head of Sales or CRO somewhere else?

- Am I hiring someone who hasn’t had the top job but has had quota responsibility at a larger company?

You want your first Head of Sales to have had experience at a business with more than 25x the current ARR of your business. Or, if you’re $10M, look for someone with $250M of quota responsibility on their team, even if they didn’t hold the title of CRO or Head of Sales. The main job of that first Head of Sales is to come in and convert a more product-oriented company into a sales-oriented, performance-driven, meat-eating culture.

That’s a big change, and they can do it by building the first incentive compensation plan that includes variable compensation for specific goals. At Marketo, Pepper’s first Head of Sales would come to board meetings with a bunch of balloons. They’d ring the gong at the meeting for all the deals that closed, and the AEs that closed those deals would pop a balloon, and an iPod would fall out. Your first Head of Sales will do everything they can to change the culture into a sales-oriented one.

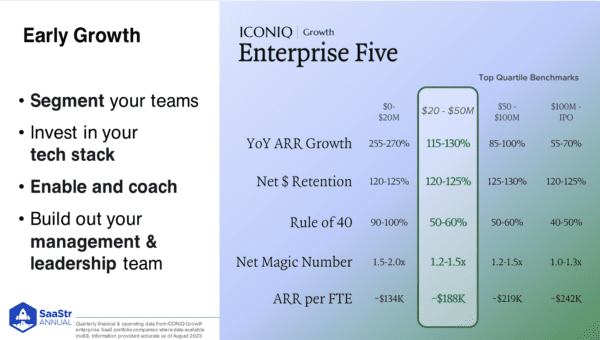

Early Growth Stage — $20M to $50M ARR

This is the first time companies are really starting to build their GTM organizations for scale. What does that mean? Hiring a lot of people and segmenting teams along a number of dimensions. Complexity and building out a tech stack to manage that complexity are happening. There’s also a management and leadership layer to enable and coach individual contributors.

On average, as companies move up toward the $15M ARR mark, they’re doubling their team size on the sales, marketing, and customer success side. At this stage, many companies experience both significant headwinds and tailwinds, and then, suddenly, the dynamics start to change. You go from growing and growing, and then code attainment comes down, and ramp time goes up. That’s why getting the right leadership in place is so important. It will minimize the decrease in efficiency and productivity as your team continues to grow and complexity increases.

How You Organize This Always Comes Down to Your GTM Motion, Customer Base, and Strategy

You can see the maturity of segmentation kicking in during this phase, with most companies prioritizing geography and size. As companies continue to scale, segments like industry come into play. You really need to understand your customer in a detailed manner to move up-market, increase ACV, and have higher touch sales cycles.

A really strong organization in place in terms of geographic presence and the size of your customers is key. Dramatically hiring a GTM team and segmenting them naturally leads to more and necessary complexity. To manage that, you need to build a tech stack. What’s notable at this stage is that the companies that are really successful with these technologies are data-obsessed. That’s the glue that pulls these systems together.

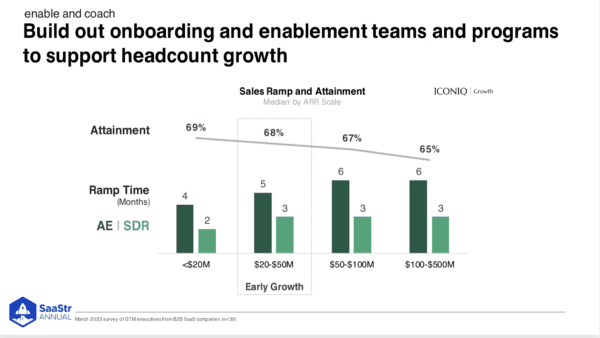

As you grow across these stages, everything gets harder. So, companies build out enablement to train and onboard salespeople with the right content and playbooks to drive an effective process and improve numbers.

How do you build out a great sales team?

By hiring great managers and leaders. Enabling and hiring amazing managers is equally as important as everything else. In the $20-$50M range, a manager can usually manage 5-7 individual contributors. Companies also start to look for a Head of Sales and a Head of Marketing who can take you up through IPO. This might feel early to some, but on average, the sales leader at the time of IPO has been with the company for around three years to have time to build out the maturity and sophistication in that revenue repeatability.

The Growth Stage — $50M to $100M ARR

This stage is all about building long-term efficient growth. Companies are moving up-market, investing more in marketing, and orienting all processes around efficiency. The percentage of sales and marketing starts to skew towards marketing, which will steadily increase because of its connection to increasing complexity.

Most successful companies grow by moving up-market, increasing ACVs, and closing larger Enterprise customers. But the reality is that while those Enterprise customers are wonderful, they’re also more complex and demanding. They ask for custom implementations, onboarding, and support.

The percentage of revenue that comes through support increases. The goal is not just to retain but to grow, cross-sell, and upsell those customers, and the increase in spend and revenue can help drive that.

Efficiency comes into play more at this stage than prior stages. Companies are still growing but are looking to do more with less and move the business model to more of an IPO business model.

One way to get that is by building a global workforce. Significant savings are possible when using a global workforce vs. onshore. But you have to have the right leadership and org structures in place in those locales, or you’re not going to see the benefit in cost savings.

The Pre-IPO Stage — $100M ARR to IPO

Now, you’re hiring an IPO-ready marketing leader, your last CMO before going public. Companies are continuing to build out their product suite and expand internationally to tell a bigger TAM story. This is crucial when going public and refining your model for IPO.

According to the data, 30% of companies hire their CMOs less than a year before going public. And a total of 54% are hiring them two years to IPO. On the dollar side, 46% are hired after $100M ARR.

That’s pretty late-stage. Why is that?

Because, at this stage, the CMO has to be multi-dimensional. They’ll continue to scale GTM and demand-gen marketing activities. Still, they’ll need to do that in a much more sophisticated way that drives the predictability required of a public company.

You also need a CMO who can do demand gen and be a storyteller to elevate the brand of a company to a public market-ready company.

The Repeatability and Predictability of Revenue Generation

When looking at where revenue is coming from, companies are expanding and diversifying the makeup of that revenue in a few different ways.

- Over 50% of revenue is generated by existing customers through upsell or cross-sell. Cross-selling requires a more diverse product suite. On average, companies at this stage have three products, yet the first core product drives the most growth.

- International expansion further builds out revenue. This needs to be a strategic decision, so companies should ask themselves a few questions.

- Do you have existing customers in these markets with compelling use cases that can be references to future customers?

- Can potential partners help you sell in the early stages as you get your team set up there?

If those answers are true, it makes sense to expand internationally. At the time of IPO, 30% of revenue is typically from non-North American customers.

When Will The IPO Window Reopen?

If you’ve done all these things and are ready to go public, you may wonder when the window will reopen. SaaS multiples rose and dropped quickly, shutting down the IPO market. So, instead of trying to guess the timing, focus your efforts on what matters in the moment — growth and efficiency.

The data of all publicly traded SaaS companies shows the key drivers of valuations and valuation multiples.

The key drivers, in order, are:

- Revenue growth. Not just growth itself but the predictability of that revenue.

- Net dollar retention. What is your ability to drive future growth from your existing customer base?

- Gross Margin

- Profitability

- Market Leadership

So, what’s more important for you in terms of valuations? Is it revenue growth or efficiency? It depends on whatever the market is stressing at specific periods in time.

They might flip-flop, but at the end of the day, revenue growth is paramount. Efficiency doesn’t go away, but without revenue growth, market share gain, and leadership in a market, you won’t get the kind of valuation you want.

Key Takeaways for What to Focus on When Scaling Your GTM Organization

Early Stage

- Find product market fit

- Transition from founder-led sales

- Build your team and hire your first sales leader

- Incentivize growth

Early Growth Stage

- Segment your teams

- Invest in your tech stack

- Enable and coach

- Build out your GTM management and leadership team

Growth Stage

- Invest in your inbound engine

- Move up-market

- Build out your support and service offerings

- Build a muscle of efficiency

Pre-IPO Stage

- Hire an IPO-ready marketing leader

- Build out your product suite

- Expand internationally

- Refine your operating model for IPO