Mark Roberge is a senior lecturer at Harvard Business School and the former CRO at Hubspot. His session was our highest-rated session at SaaStr Annual 2019 and you’re about to see why. He provides an in-depth guide to driving revenue growth at your company and what to expect at each stage. The three stages are product-market fit, then go-to-market fit and lastly growth and moat. Regardless of what stage you are in, he provides a framework to systematically approach this stage and what you should focus on to get to scale faster.

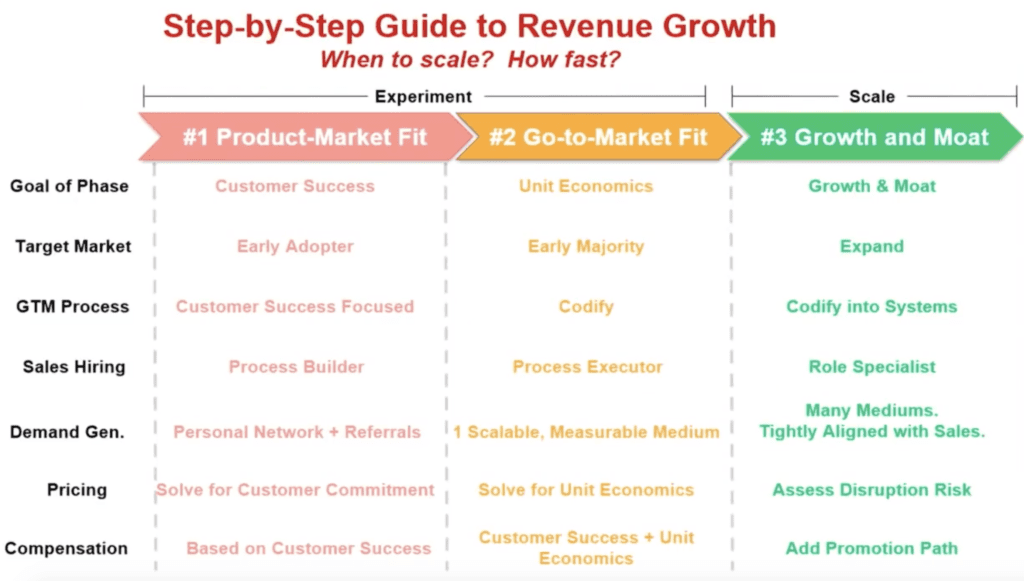

Here’s a quick overview of what to focus on during each stage:

Want to see more content like this session? Join us for SaaStr Annual 2020.

FULL TRANSCRIPT BELOW

Mark Roberge– Senior Lecturer at Harvard Business School; Former CRO at Hubspot

SaaStr, good morning. What are you doing up so early? Alright, we’ve got a fun journey today. Get right into it.

What’s the failure rate for a Series A start up? If you measure failure as don’t even give the money back to the investors. Seventy-five percent. What’s the failure rate of a Series C start up? Got Series C funding, you’re further along. Seventy-five percent. We are screwing up the scale. And I wanna work with you all today, I’ve been working on a little framework to think about it and hopefully … I’ve been working with a bunch of companies on it, I’d love for you to take it, play with it and improve it.

Okay so start off quizzing the chart, take a sip of your coffee, 9:00am. Awesome revenue growth on the X axis, awesome revenue retention on the Y. The question’s not, where do you want to be?. That’s easy. The Holy Grail, upper right. Hundred percent revenue retention, 200% revenue growth. The question is, how do you want to get there? What’s the best way? Option A is we can go have awesome revenue retention, 100% revenue retention, but mediocre growth. Thirty, 50% revenue growth.

Option B is awesome revenue growth, 200%, but mediocre revenue retention, 70%. How many people wanna go Option A? How many people want to do Option B? Alright, Option A has it. You’re smart. We’re talking a lot about this. I don’t think we think that way though. Getting back to the Series C failure, I don’t think we think that way. When someone says, “How’s your company going?” What’s the first thing you say? How fast you’re growing revenue. If you’re an investor, what’s the first thing you ask them? How fast are you growing revenue? We should be talking about revenue retention, because I don’t think that second path actually exists in my experience. It’s much easier to put out the throttle once we’ve got great revenue retention than it is to actually fix a retention problem while we’re scaling. You actually have to slow stuff down to speed it up, so why not just start there?

So that’s what I wanna throw out there today, is a framework on how to think about it deeper than just, hey let’s get product market fit and then lets add 20 reps. Because in my experience, you’re firing 20 reps a year later. You haven’t checked the boxes. And so I just want to throw in a framework around product market fit measured by customer value creation, then go to market fit measured by economics, then we scale fast. Growth and milk. It’s not that we slow down, it’s just that we work on the right things.

So first off, I’m saying we start with customer success. What is sales? What is sales? Isn’t sales really around customer value creation? And revenue is an outcome. Sales is not about revenue generation, it’s around customer value creation. Revenue is that outcome. Okay? So let’s figure out why did that actually happen? Why are we so obsessed with sales being focused on revenue? And I think it comes out of the 80s and 90s and how we used to sell with shelfware. How did that gain work? We sold software. It cost millions of dollars. These people deployed servers in there office once they purchased it. It was all about getting the contract. Once you had the contract, all the servers were set up, you flew in your professional services people, it took six months to set it up, it took six months to train people, and the product sucked, but it didn’t matter. No one used it, but it didn’t matter. And that’s where shelfware came about. Some executive put their career on the line to buy your stuff and walk around saying, “It’s awesome”. But things have changed, thanks to you.

We have the subscription revenue. The subscription economy. It’s so easy to use products now, but it’s just as easy to leave. Totally changes the game. It’s all about churn and retention. And we’ve got this megaphone called social media, that every single customer can talk about a great product experience, and they can also talk about a bad one. The first thing people do when they see a product, is they Google you and see if you have a one star or five star rating.

The game has changed but we haven’t caught up. Sales is first and foremost around customer value creation, revenue is an outcome.

The game has changed but we haven’t caught up. Sales is first and foremost around customer value creation, revenue is an outcome.

So how do we measure customer success? A lot of people are talking, yeah customers, start with the end. A lot of you are talking about that. How do we measure it? Yes, revenue retention, logo retention. North of 90% annual logo retention, north of 100% revenue retention, that’s awesome. However, that is a trap. Because churn is a silent killer. You can be marching around and thinking you’ve got it all worked out, you signed up 50 customers, you’ve got them on annual contracts, they’re all still paying you. But a year later, half of them cancel. Churn is a lagging indicator, and as start ups, as GMs of new products and new markets, we can’t use churn as an indicator to learn. It’s too much of a laginator, so we have to identify a leading indicator to learn fast.

And I think a lot of you caught the aha moment. What is your aha moment? For Slack, it was one that a team sends 2000 messages. For Dropbox it was when a user added a file in a folder on a device. For HubSpot it was when people use five of the 25 features in the product. At that point, their correlation to long term value was huge. If they didn’t do it, they’re a flaky customer.

What do you know in the first 30 or 60 days of your product usage that becomes your aha moment? Can you measure it? Is it correlated to your unique value proposition? Then you’ve got it. And then measure it. If you ever asked me to come to your board meetings, I want this to be the first slide. I want this to be the first slide. This is how I think we quantify product market fit.

And so what this means is, okay in January we signed up 24 customers. After one month, three percent of them hit the aha moment. Three percent of them say, set the product up and use it every day. But after two months, 27%. After six months, 39% were doing it. And look what happens as we go down the chart? We’ve been running a bunch of experiments. We’ve been working on product market fit. And in August we signed up 39 customers, two months later 56% use the product every single day. Compare that to where we were in January. Only 27%. We’re doing awesome stuff, we have product market fit. We are creating customer value, let’s move to the next step.

So this, in my opinion, should be that first slide in the board deck. And then once you set it up, align the whole go to market around it. The sales person that you hired as number 10 in growth stage is different than the sales person you hire at this stage. It’s a little bit more like a product manager and a sales person. It’s not the person that you’re gonna give the deck to and say, “go”. They’re gonna say, “it’s not working”. It’s the person that talks to customers and does great discovery and comes back and says, “hey listen, I think we’re a little off and this is what we need to do”. And we don’t pay them just on revenue, we pay them on set up. Half of it happens on the revenue, half of it happens when the set the product up. Right?

Customer success is not measured by retention, it’s a lagging indicator. They’re measured on the set up. Marketing is not just MQOs to drive revenue, marketing is about getting MQOs around customers that love our product. We’ve gotta check off this customer success box, and product just obsesses over the chart. They just go back to the chart and they obsess, why are only 27% of the customers using our product every single day in the first two months? And what can we change to adjust that.

Customer success is not measured by retention, it’s a lagging indicator. They’re measured on the set up. Marketing is not just MQOs to drive revenue, marketing is about getting MQOs around customers that love our product. We’ve gotta check off this customer success box, and product just obsesses over the chart. They just go back to the chart and they obsess, why are only 27% of the customers using our product every single day in the first two months? And what can we change to adjust that.

We revolve the whole company, the whole global market machine around solving customer success, and we put them in a room together. Every night at 5:00pm let’s do film review. “Hey Mrs Salesperson, record your discovery call, let’s get a room”. Product, marketing, customer success, let’s listen to what the customer is saying and let’s figure out if we’ve got it right.

How often we run that meeting is how fast we learn. Run a daily film review, 5-6pm every night to move this process accordingly, and now you’ve got … hopefully check this off and it’s all green. Okay? So now I have an opportunity, not just do I have the framework, but I have guides to who I’m going after, how I’m running my playbook, who I’m hiring, how I’m comping my rep. Pricing doesn’t really matter at this stage. Just make it high enough that they’re committed to setting it up. Free is not good, ’cause they’re not committed. Pricing is around commitment. But this changes as we check that off. If you check that off now we can move to your economics.

And you folks know this stuff. LTV:CAC greater than three, payback period greater than 12. This is go to market fit. If you scale prematurely we’re gonna scale a cash bleeder. So now we can set ourselves up around this and our plan changes. We have to expand the market a little bit. Now we’ve got someone who’s going to follow the process, not just build it. We have to codify our sales process. Pricing and demand gen matter a ton to get LTV:CAC work. And our comp plan does as well. It’s gonna drive our CAC. So this gives us a little bit of flavor as to where are we in this journey and how does that stage influence the decisions we make.

Okay let’s get into the fun part. Growth. So when are we ready to grow and how fast. So now that we have this in place, this is our speedometer. This is our speedometer. If you’re telling me that two months into a customer lifecycle, 70 or 80% of those people set the product up and use it every day, awesome. You have product market fit. And if you’re telling me that as you watch that the LTV:CAC is greater than three and the payback is less than 12, when you run through your pricing and your comp plan and your conversion rates, awesome. You have go to market fit. Let’s scale. And scale is not like hire 20 reps tomorrow. Scale is a pace. It’s a pace.

So let’s say, hey let’s add one rep every other month and let’s watch our speedometer and let’s do that for six months. And if we do that, if we go from two reps to seven over that time period, if this still looks good, let’s go faster. Let’s add one rep a month, or let’s add two reps a month and keep watching. And when it breaks, let’s slow down and fix it. But at least we have a better framework around when to scale so we can solve that 75% failure rate of Series C companies, and bring this stuff up in a little bit more of a systematic way.

Okay. So some companies follow that, they call me up and like, “Mark, we nailed it. We’ve got it. Ten million revenue, 200% year over year growth, triple, triple, double, double, 4.3 LTV:CAC, we’re killing it. We raised 30 million bucks, we can expand the team. We’re going for it. We’re gonna go from 10 to 30”. Usually what happens is they go from 10 to 15 and churn increases. What happened? They never looked under the hood to see what was going on. Usually you only have product market and go to market fit in a smaller slice than you think. And what the company essentially did when they looked under the hood was, holy cow. If we split up our company by the size of customer and how we went after them, we only had product market and go to market fit in the top center. We really only know how to sell the mid market companies through inbound demand gen.

Great. Five million, eight month payback period, six percent logo churn, you nailed it. Product market and go to market fit. But you haven’t figured out the rest. Outbound, you’re payback’s way too big. You’re adding BDRs but they’re not efficient enough. Enterprise, no one’s using the product. You haven’t figured out your onboarding, and the small business that churns too high. But guess what? When we raise the 30 million bucks we didn’t notice. When we raised the 30 million bucks we realized mid market wasn’t enough to scale, inbound wasn’t enough to scale, so we added a bunch of BDRs and we hired this really expensive enterprise sales team, and we did it prematurely.

We never looked under the hood and realized whether we truly had product market and go to market fit. Had we done it again we could have said, okay I know exactly when I’m ready for scale, and I know exactly when I need to exact. I gotta figure out the other boxes, otherwise I’ll never get to 30, 50, 100 million dollars. So we gotta crack the nut on those boxes and the answer to that is not add 20 reps and go. Like when we started our company we didn’t say, “hey I have an idea, let’s add 20 reps and go”. No, we’re great at … let’s add a couple engineers, and a cross functional team and experiment, experiment, experiment, and figure it out. So that’s how we have to set this up. Is yeah, let’s go from 10 to 30, but let’s go in the right spot.

Let’s really triple down and mid market inbound, that’s what we know how to do, and let’s set up three cross functional experiment teams and keep them small. And help them to figure out how to sell the enterprise. Help them to figure out how to do outbound. Help them to figure out how to do the S&B, and check off product market fit, and check off go to market fit, and cross our fingers that six or 12 months we’ve got one of these to go and now we can move into scale. So we have too broad of an optimism around whether we’ve actually figured out our business.

The other thing that happens is sales and market alignment. We gotta add some new mediums and we really gotta instrument sales and marketing together. I’ve worked with hundreds of teams on this. Sales and marketers hate each other, so this is like a problem. Like all marketers think sales people are overpaid spoiled brats. And all the sales people think that marketing does arts and crafts all day. And they just end up going back to their relative corner of the office and set up their trade show booths and do their cold calls, and that’s the kiss of death in today’s environment where 90% of customers start their buying journey in a domain owned by marketing, i.e. the website, social media, email, etc, and they progress into a domain that’s owned by sales. And if these two people are not getting along, it’s the kiss of death for your company. But if you can align them, it’s a huge competitive advantage.

So how do we do it? I’m not a huge fan of the lead score. You know I’ll go back … you guys know Volpe, he was my kind of partner in crime at HubSpot in setting this up, and we were really kind of pointed about it. We said, okay, we know we have 10 mid market reps and each mid market rep needs 50 leads a month to hit their number, and we know they’re gonna connect with half of them and convert half of those to a demo, and close 30% of those demos for an average of 700 MRR. Like clockwork.

So Mike, I have 10 reps that each need 50 leads, I need 500 of those mid market leads. That’s really good, but some of those leads were VPM marketing that downloaded an ebook, and some of those leads were VPM marketing that requested a demo. They both counted. But which one closed at a higher rate, the ebook or the demo request? It was the demo closed by three times. But which one was easier for marketing to generate when they came to the website? Much easier to get someone to download an ebook.

So when Mike’s team fell behind on the SOA, all the calls to action is turning to eBooks and we were like, where are the demo requests? So we got a little more pointed around it. We separated our lead flow into quality of customer on the left side … the quality of the company, not the role, the company … and the engagement. ABC, very simple.

Alright, so hey, let’s just make it up. Over 10000 is an A, in the middle is the B, and under 1000 is a C. They all qualify, just different amounts. And in engagement let’s make it up, a blog sign up is a C, ebook download’s a B, demo request is an A. Now I can put some prices on this. So over time I can actually multiply the close rate times the number and how much they spend and actually get these numbers, but in the beginning let’s just make it up. Alright so I’ll give you a hundred bucks if you generate AA, I’ll give you 10 bucks credit if it’s a CC. Now I’m in a position to put marketing on a revenue quota. Marketing on a revenue quota, yeah. So it goes from 500 leads a month to $500,000 of lead value. And if you wanna get there through, whatever the math is, like 500 AAs or 5000 CCs, I’m gonna make my number. And so all of a sudden all the calls to actions on the site change to higher quality stuff, like demo requests and trials, because we’re giving marketing proper credit for it.

Now sales does not get off the hook. This is a two way relationship. If marketing is gonna be that specific, sales needs to be too. So I used to do a lot of studies around, I knew I need a call lead right away, we’ve seen those studies. I know that I … call them a lot, but like how often? Like do I call when I get … when I call a lead and I get a voicemail, do I call them that afternoon? Do I try them again tomorrow? Do I try next week? Do I try them five times or 10 times. Like these questions started to stress me out. For each rep, should I give each rep one lead a month and tell them to call the lead 1000 times, or do I give them 1000 leads a month and tell them to call each lead once? I don’t know. Either one of those answers is not good, but where’s the right time?

So I did some analysis and this was in the HubSpot funnel when we were like 50 million and I think we had 100 reps. And some of the leads they only called twice, as we show on the x axis, and y shows the profitability. Some of the leads were called 15 times. So you call a lead 15 times, you’re gonna get them on the phone more often, you’re gonna close more deals, but is it worth it? That’s a lot of work. Calling them once, yeah we gotta do a better job than that. So where’s the optimal amount? Well for small businesses, shown in the orange, the optimal amount was five. For mid market it was eight and for enterprise it’s 12, and that correlates with a lot of research that’s been done in this space.

And so now I had this blueprint that I could go the reps and say, folks we have calculated the path to making the most money at HubSpot, and they’re like, woo I love that. And folks, we have built it into the CRMs. You don’t have to think about it. You hit voicemail, that you left a voicemail and it just goes away and comes back. Love that. And then we’ve codified it into our systems. So we built a chart that says, the do not be on it chart. Very easy to do, any CRM you want. It’s just, what are the rules? Okay you call a lead within two hours. You call a lead three times in seven days. You call a lead six times in 21 days, and just build it in. And it’s basically if your name shows up on this chart, you’re violating the rules. So just don’t be on it.

And now I’ve got a situation that I can manage and monitor the heartbeat of my go to market, the heartbeat of my company on a daily basis. Every night this dashboard went out to the whole company. On the left hand side, where is marketing against that $500,000 goal? It’s halfway through the month, the red line’s perfect and the blue line crawls along there. Now I can’t have marketing crush it in the beginning and then take the rest of the month off, because I don’t have the reps to call that many leads at once. And I also can’t have them go to sleep for three weeks and make it up at the end of the month, because I have reps sitting around for three weeks twiddling their thumbs.

So there’s a lot of science in here that they have to crawl that orange pretty closely, and then for the reps they don’t get off the hook. But don’t be on it, I measure my heartbeat every single day, and I know very quickly if it’s broken. I’m not waiting til the end of quarter revenue number to know how we’re doing.

Alright, then we’re gonna talk about the hiring in the role. What do you look for in a sales hire? What do you look for in a sales hire? Any hire I made … we were just like 15 people in a garage across from MIT. And I convinced this person that was the number one sales person at a big public company in Boston. They had 800 reps. And this person said, I’m quitting, I’m gonna join this small company called HubSpot. And I was like, wow this is amazing. Rolled out the red carpet. Welcome. Teach us to sell. And I was amazed, they didn’t crush it. They weren’t terrible but they were kind of mediocre. I was like, how is that possible? How is that possible, 800 reps, they’re number one … we had this rinky dink job with seven reps and they’re not our number one.

And I thought about it and I’m like, holy cow, the context is so different. This person’s literally working for a company that’s doing Super Bowl ads. You call them up and they know exactly who you are and what you’re selling, and the sale takes five minute. No one knew who we were at the time, no one knew what inbound marketing was. It was a very complicated sale and you could imagine the type of rep that works and those two different contexts are extremely different.

So I realized at that point, it’s very dangerous to be at a show like this and go to your neighbor, hey what do you look for in a sales rep? Because your contexts are different. Copying it could be disastrous. However, there is a blueprint that you can build that’s really important in your scale, to be able to engineer your sales hiring formula. And so I just sat back at that moment and I said, okay. What is it about our context that … what are the characteristics that correlate for us and how weighted should each one of those be. And I was really specific around what did I mean by curiosity, and what did I mean by prior success, and would a low, medium and a high score sound like? And I worked on this over and over again as we watched people do well and not do well.

And so over time once we hired 30 of these, you can actually … you run a regression analysis. So I got a PhD at MIT who was like salivating over this data, loved it. And he ran this analysis and it showed that the characteristics at the top had a really strong correlation with success. And the ones at the bottom were actually negatively correlated. I was blown away by this. Because at the time we were talking about how the customer’s desiring a different type of seller, but this statistically showed it. It’s like the stuff that we typically associate with a car salesperson, closing ability, convincing, objection handling, negatively correlated. And the stuff at the top, preparation, domain experience, intelligence, that’s how we’d describe a great consultant or adviser. And it totally set the tone of the type of team that I wanted to build.

So anyway, this is a key thing that we’ve gotta do, especially in the scale mode, is we wanna set that quantitative framework and test, test, test. Six months into a reps life cycle, are they doing great? Yes or no. If they’re doing great, why? And do we look for it in the interview process? And if they’re doing poorly, why didn’t we catch it? And we can iterate on it.

So a quick little quiz. So these five components here, these three components are all in the top five over time as we approached IPL for HubSpot. But which one do you think was number one? How many people think intelligence was the number one correlator to sales success? How many people think it was coachability? How many think it’s curiosity? Ah gotcha. It was coachability. Everyone always thinks it’s curiosity, but coachability was the one. I don’t know why it was. Maybe because we were doing things so differently. But it was those reps who checked all the other boxes, huge success, but they showed up on the first day and they said, Mark thank you for the training but I’ve been selling for five or 10 years, I’ll just be in my cubicle selling. And there was an issue.

And so the coachability was really a thing, and that’s my favorite part of … I’m not gonna go through these, but these slides are posted on my LinkedIn and my Twitter if you wanna download them. They’ll hit in like a minute. But if you wanna go through and copy or get ideas around our interview process … my favorite part was the role play. Just have them do the role play, see how they did, coach them on it, and have them do it again. That process was so correlated to my ability to pick sales people.

Alright, now the other thing’s the coaching at this point. That’s was a sales manager does, hire, coach, hire, coach, not run pipeline. Hire, coach, hire, coach. Not do the job for the reps. If they do these two things well, they get a scale.

What’s a good coach. So I’ve been trying to learn golf for like 15 years. I’ve taken like 10 lessons. One golf pro he says to me, Mark take a swing. And I did. He says, okay here’s what you need to do. Turn your grip over a little bit, lean back in your stance, put more weight on your right foot not your left, think one o’clock not two o’clock in the back swing, and give me more wrist on contact. And I was like, are you kidding me? Another coach said, okay Mark, take a swing. So here’s what I want you to do. Turn your wrist over a little bit. Now take a hundred swings. Twenty minutes later he’s like, how’s that feel? I’m like, I think I’m getting this, this is pretty good. Now lean back in your stance a little bit. Take another hundred swings.

It’s such an obvious example but I’ve personally promoted 50 reps to manager and they all use the first golf pros approach. They get a new rep out of training, they see them messing up on 50 things and they throw up on them for 90 minutes with feedback. And you can just see the rep’s head spinning and nothing changes. The best coaches will identify the … they’ll see the 90 things, but they know the one that’s the most broken, and they focus there. And they use the metrics to diagnose it.

So if you look at this particular … this is a funnel, each color is different reps at each stage. The person in the purple is really doing bad, they’re the worst in the team. They’ve sold the lowest number of units. But why? Why is that? Well they’re making tons of calls, they’re just not getting them to the demo. And I can actually click in further and realize, you know what? The reason why they’re not getting the demo, is it because they’re working tons of leads and no one’s calling them back, or is it because they get the on the phone and someone hangs up after 30 seconds? My coaching is way different but I can use the numbers to diagnose it. And so I call that metrics driven sales coaching.

Once you get to a big org what I do is on the second day of the month, I’d meed with all my directors and ask them, what are you coaching everyone on? For John, what are you coaching him on? How’d you choose that and how are you gonna coach him? And because I did that, all my directors would have the same meeting with their managers, and their managers would meet their reps on the first day of the month and they’d build out this whole process. We’d walk out of the first day of the month knowing exactly what we’re working on with each rep, they’re totally bought in in how we’re measuring success. And now I can hold my reps accountable to that. Month over month I go to paper trail, and I can say, Bob you love John, you hired John six months ago and John is not doing well. And you said you’ve been coaching him on sense of urgency development for three months now and he’s not moving. You hired him, you’re coaching him, you’re accountable.

My mentor was a little more aggressive than that, he’d say, go to the bathroom, look yourself in the mirror, and ask yourself, are you a bad recruiter or a bad coach, ’cause you messed up somewhere. And this process gives us a way to hold our large organization accountable to really good coaching. It applies to big sales too. This is just a different … this is an example from InsightSquared, but this just shows for million dollar deals, you’re just showing how things move through the funnel for six months. Doesn’t have to be calls and all that kind of stuff, but you’re just measuring progress through the funnel. Okay. So there you go. There’s hopefully a tighter rhythm around how we actually … when are we ready to scale, and how to scale.

The last part I want to do is on compensation. This one’s not talked enough about. We’re losing reps too quickly, and it really … it amazes me, why for a role where success and failure are so quantifiable … like I can’t walk into an engineering team and be like, hey this is Julie, she’s my best engineer by seven percent. Like, how did I do that? But sales I can. Hey, sales team, this is Julie. She’s my best seller by seven percent. I can do that. So why do we comp our reps on an annual raise of three percent? It’s silly. And why do we make it based on a year when it’s so quantifiable?

So what I’ve used in a lot of companies is put in, hey you’re a sales associate, you join, you make 40,000 base, 40,000 variable, I give you 5,000 options. When do you get promoted? You get promoted when you hit the stuff on the right. When you have sold over $60,000 of business, MRR. When your last three months you average over 5,000 a month. When your contract values are over six months, you get promoted. It could take you six months, some people it took 20 months. But when you do, we’ll raise your variable, we’ll give you 10,000 more options and there’s your next target.

I’ve seen companies keep their reps for over seven years when the average in the industry is 2.2, using this method. So hopefully that gives you a little bit of flavor, a little bit of framework. I’d love your feedback on as you try it. I’ve used it for probably like 25 companies, it’s worked quite well in terms of knowing where you are in your journey, when to scale and how fast, and how you align your go to market around it.

I wanna just talk about one thing. There’s a great investor, Jay Po, Bessemer, came here last winter. He’s like, we need to put this into Venture. We need a Venture firm that’s backed by go to market professionals and run by go to market professionals. I was like, dude that’s a big idea. Don’t quit your job yet. Let me introduce you to my buddies and let me see if they’re into it. And he crushed it, and got a lot of their money. So he added Jill Rowley, the former Chief Growth Officer at Marketo, and formed this company called Stage 2 Capital, where we’ve made five investments and had great backing from the community on the go to market front.

Sixty sales, marketing, customer success, CEO oriented executives. Jay Simons, the president of Atlassian, Emmanuelle Skala at Toast, O. Jay who used to run sales at Dropbox and now Asana, Halligan at HubSpot, Sydney Sloan at SalesLoft, Hilary over at Zoom … these people are backing this movement around bringing this go to market mentality to the investor side. So if you’re ever interested in something like this, check this out and we’re gonna try to add to the start of ecosystem from this perspective.

The other thing I wanna thank you about is the continued support on the book. It’s my most sales here in Silicon Valley, so thank you. I think a lot of you know that 100% of the proceeds are donated to Build.org. My friend Ayele just got promoted to CEO last year and she’s doing an awesome job. Anyone involved in Build? Build is awesome. They bring entrepreneurship to the high schools that are struggling most in the top 20 cities in the country, and they teach these kids how to be an entrepreneur freshman year, with a goal of getting into college. Ninety-nine percent of these kids graduate high school, and 85% go into college, and that is way higher than the rate. And thanks to your support, the book has given them over $50,000 in donations. So I thank you.

And I’ll just leave it with one more thing, which is, hey I’m the appetizer this morning, for the main course, which is diversity. Yes, scaling is exciting, revenue growth is exciting. We hope to influence the ecosystem, but this is the most important movement that we have going on in 2019. We’ve been working on it in Tech, in Venture, in entrepreneurship, in business, for 20 years. It feels different this time. It feels real. And I think Jason’s gonna come up and tell us more about this. But these two ladies at Salesforce have done an awesome job, and I can’t wait to hear more about that story.