Curated B2B jobs at the best, up-and-coming SaaS Companies.

Hot Jobs!

Blog Posts, Early, Fundraising, Q&A

Blog Posts, Early, Fundraising, Q&A

The Many Types of Angel Investors

Dear SaaStr: Are there different types of angel investors that should be sold differently when trying to raise money to start a business? There are several key types. Let’s break them into several categories: Professional vs. non-professional. Professional angels generally have very specific criteria in terms of valuations, team make-up, check size, etc. You do…

Continue Reading

Blog Posts, Q&A

Blog Posts, Q&A

Dear SaaStr: What Was Your #1 Hack to Increase Trial Conversions to Paid?

Dear SaaStr: What Was Your #1 Hack to Increase Trial Conversions to Paid? The quickest hack I did was answer all calls and chats immediately. I opened up a remote phone bank / set of agents just to answer trial users’ questions; and I made sure every chat that was in a trial was answered…

Continue Reading

Blog Posts, Early, Fundraising, Leadership, Q&A

Blog Posts, Early, Fundraising, Leadership, Q&A

Dear SaaStr: How Can I Remove a Troublesome Investor from my Cap Table?

Assume you can’t kick out investors. And plan accordingly. There are some limited exceptions, especially if you do nonstandard types of convertible debt or only raise a very small amount of capital. But for the most part, you are stuck with your investors forever. In the U.S. and Delaware and California, and under standard VC…

Continue Reading

Blog Posts, Q&A

Blog Posts, Q&A

7 Things That Separate The Best Founders From the Less Successful Ones

Dear SaaStr: What Are Some Common Mistakes Made by Less Successful Entrepreneurs? Mistakes less successful (but not total failure) entrepreneurs make: They can’t control the burn rate. You can slow down time if you raise a bunch of VC money, but you can’t stop it. They hide from tougher metrics. High churn, lower-than-hoped margins, low NRR,…

Continue Reading

Blog Posts, Early, Fundraising, Q&A

Blog Posts, Early, Fundraising, Q&A

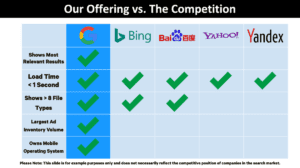

Dear SaaStr: How Much Should I Talk About the Competition in a Pitch Deck?

Dear SaaStr: How Much Should I Talk About the Competition in a Pitch Deck? The best startup pitch decks almost all have great competition slides. Why? Because the best CEOs: Respect the competition. Even if they plan to destroy them. Know the space cold. Even in the early-ish days. See and can explain the whitespace they…

Continue Reading

Blog Posts, Exit Strategy, Q&A

Blog Posts, Exit Strategy, Q&A

Why Founders Leave After Acquisitions

Why do founders leave after their companies are acquired? There are many nuanced answers, but in the short and medium term, it’s incentives. Acquirers use 3 incentives to get founders to stay: Sticks. If you leave, you lose X% of the consideration. Acquirers try to put 30%-40% of the founders’ consideration at risk, if they…

Continue Reading

Blog Posts, Q&A

Blog Posts, Q&A

Dear SaaStr: How Do I Actually Start a Successful SaaS Company?

Dear SaaStr: How Do I Start a Successful SaaS Company? I think there are approximately 2 ways to get a new SaaS app off the ground: Option 1: Hustle into The Enterprise. In almost every category of software, there are gaps. Painful gaps. Generally, several gaps that any buyer has and would pay, say, $5k…

Continue Reading

Blog Posts, Q&A

Blog Posts, Q&A

Dear SaaStr: When Do VCs Try To Replace Founders as CEOs?

Dear SaaStr: When Do VCs Try To Replace Founders as CEOs? You’re worried about a bunch of VCs replacing you. That’s fair. You should be. It happens. Regularly — but not usually. A few high-level things to think about. First, if you really screw up, shouldn’t you be replaced? Second, if you don’t end up…

Continue Reading

Blog Posts, Early, Fundraising, Leadership, Q&A

Blog Posts, Early, Fundraising, Leadership, Q&A

Dear SaaStr: What Happens if a VC Loses All Their Money on an Investment?

Dear SaaStr: What Happens if a VC Loses All Their Money on an Investment? It’s OK — if it’s not too much. As long as the founders did everything they possibly could to make it work. Everything. And were honest. There are two types of losses for VCs and professional investors: losses than fit into…

Continue Reading

Blog Posts, Early, Q&A, Sales, Sales

Blog Posts, Early, Q&A, Sales, Sales

Dear SaaStr: As a CEO New to Sales, How Can I Get Better at Closing Deals?

Dear SaaStr: How Can I Get Better at Closing Deals? If it’s very early, hire 1 or ideally 2 sales reps who you’d personally buy from. You’ll all learn from each other how to close better, and faster. The #1 trick to making sure your first sales reps work out? Only hire sales reps you'd…

Continue Reading

Blog Posts, Early, Fundraising, Leadership, Q&A

Blog Posts, Early, Fundraising, Leadership, Q&A

Dear SaaStr: How Do I Craft a Winning Investor Deck for an Early-Stage Startup?

Dear SaaStr: How Do I Craft a Winning Investor Deck for an Early-Stage Startup? Here’s my #1 piece of advice: Get it all down to One Slide. "How to Create a Compelling Investor Deck: The Power of the First Slide" pic.twitter.com/AyyS7lHATz — SaaStr (@saastr) March 22, 2024 With 6-7 points on that slide. Not more. …

Continue Reading

Blog Posts, Career Growth & Advice, Early, Leadership, Q&A

Blog Posts, Career Growth & Advice, Early, Leadership, Q&A

Dear SaaStr: What Are The Top 5 Things I Should Know Before Starting a SaaS Startup?

Dear SaaStr: What Are The Top 5 Things I Should Know Before Starting a SaaS Startup? My Top 5: It will take you at least 24 months to really get anywhere. Everyone mentally budgets 10–12 months. It’s never enough. At least, not to get enough paying customers from Code Zero. A little more here: https://www.saastr.com/if-youre-……

Continue Reading

Blog Posts, Early, Marketing, Product, Q&A

Blog Posts, Early, Marketing, Product, Q&A

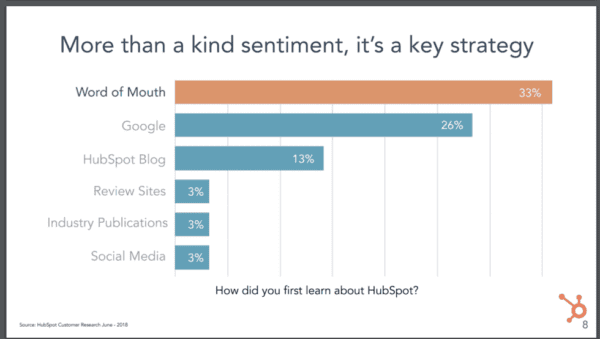

Dear SaaStr: Does It Make Sense For Your First Marketing Hire Be a Product Marketer?

Dear SaaStr: Does It Make Sense For Your First Marketing Hire Be a Product Marketer? No. Strong Disagree. It does not make any sense, 99 times out of 100. And you can see in this short clip, the CMOs of Zapier and HubSpot agree 😉 "The Importance of Hiring a True Demand Gen Marketer for…

Continue Reading

Blog Posts, Early, Q&A, Sales

Blog Posts, Early, Q&A, Sales

Why Customers Hate So Many Salespeople. And Why They Love Some. And How to Do Better Here.

Dear SaaStr: Why do customers hate salespeople? Disalignment. A truly great salesperson is a resource. They help you: They educate you on the product. They honestly answer your questions. They address your concerns, seemingly patiently. They help you pilot / test the product first, in a way that drives things forward without too much pressure….

Continue Reading

Blog Posts, Customer Success, Early, Marketing, Q&A

Blog Posts, Customer Success, Early, Marketing, Q&A

Dear SaaStr: What Do You Do When Your Startup is Not Growing Anymore?

Dear SaaStr: What Do You Do When Your Startup is Not Growing Anymore? First, be honest about why. You can blame it on macro issues if you want, but if growth has radically decelerated, it’s likely because you are less competitive than you were before. You probably have fallen out of product-market fit, partially or…

Continue Reading

Blog Posts, Early, Marketing, Marketing, Q&A

Blog Posts, Early, Marketing, Marketing, Q&A

Dear SaaStr: A Big Tech Co Launched a Competitive Product. How Can I Tell How Serious They Are About It?

Dear SaaStr: A Big Tech Co Launched a Competitive Product. How Can I Tell How Serious They Are About It? In SaaS at least, I’ll give you one metric that is fairly reliable: How many dedicated sales professional do they have, just 100% selling the competitive product? If it’s none yet, it’s an experiment. If…

Continue Reading

Blog Posts, Exit, Exit Strategy, Leadership, Q&A

Blog Posts, Exit, Exit Strategy, Leadership, Q&A

Dear SaaStr: How Do You Build a Real Exit Strategy?

Dear SaaStr: How Do You Build a Real Exit Strategy? First, bear in mind acquisitions are relatively rare. The vast majority of startups will never get one acquisition offer, let alone a good one. Still, it’s not random. I’ve been through it twice as a founder and about ten times as an investor. At a…

Continue Reading

Blog Posts, Exit Strategy, Q&A

Blog Posts, Exit Strategy, Q&A

Dear SaaStr: When You Sold Your Startup, What Were the Downsides?

Dear SaaStr: When You Sold Your Startup, What Were the Downsides? When you sell: it’s not yours anymore; and your upside is capped. Start with Challenge #1. Ask yourself 4 “Are You OK With” questions: The name being changed? With the business being shut down in 2–5 years, if it isn’t strategic anymore — no…

Continue Reading

Blog Posts, Hiring, Q&A

Blog Posts, Hiring, Q&A

Dear SaaStr: Is it OK to Reschedule a Job Interview with a Founder?

Dear SaaStr: Is it OK to Reschedule a Job Interview with a Founder? It’s generally fine to reschedule an interview set up with a recruiting manager or similar. They’ll figure it out. That’s their job. But — be careful rescheduling a job interview with a founder CEO — especially at the last minute. If it’s…

Continue Reading

Blog Posts, Q&A

Blog Posts, Q&A

Dear SaaStr: What are Some Early Signs a New VP isn’t Going to Be a Fit?

Dear SaaStr: What are Some Early Signs a New VP isn’t Going to Be a Fit? The top one for me is when they don’t embrace the goals given to them. I see this again and again: A VP of Sales that just sort of ignores the plan for the next quarter or two. A…

Continue Reading

Blog Posts, Early, Fundraising, Leadership, Marketing, Q&A, Sales

Blog Posts, Early, Fundraising, Leadership, Marketing, Q&A, Sales

Dear SaaStr: Why Do VC Backed Startups Seem To Almost Always Be Running Out of Money?

Dear SaaStr: Why Do VC Backed Startups Seem To Almost Always Be Running Out of Money? The #1 issue I see is not understanding what investments really are accretive — and which aren’t. And so the money goes far, far faster than anticipated. Venture capital, if you raise it, is there to invest. You don’t…

Continue Reading

Blog Posts, Early, Product, Q&A

Blog Posts, Early, Product, Q&A

Should You Build a Feature Just to Close a $50k Deal? Probably, In the Early-ish Days.

Does the advice to always say no to sponsored features would also apply to a SaaS startup selling to mid-market (ACV 20k to 50k+) and has relatively few clients? No. This is not wise advice, it is bad advice in many cases. As long as the deal size is big enough. At least, in the…

Continue Reading

Blog Posts, Early, Fundraising, Leadership, Q&A

Blog Posts, Early, Fundraising, Leadership, Q&A

Dear SaaStr: What Will Venture Capitalists Do if Our Startup is a Loss?

Dear SaaStr: What Will Venture Capitalists Do if Our Startup is a Loss? Move on. Especially, if you’ve only raise one VC round or so. This is telling article re: Bill Gurley, one of the best VC investors of all time: “I give Bill a lot of credit because Bill said, ‘I understand, this happens,’”…

Continue Reading

Blog Posts, Q&A, Sales

Blog Posts, Q&A, Sales

Discounts, Expiring Deals, and Urgency: Understanding Human Behavior in Sales

I’m not that great at sales myself (not really), but I am a student of it. A few things I’ve observed about human behavior, negotiation, and good and bad sales processes in SaaS: Customers that expect a discount really expect a discount. It’s generally easier to mark up the pricing a bit, then discount —…

Continue Reading

Blog Posts, Early, Q&A, Sales, Sales

Blog Posts, Early, Q&A, Sales, Sales

Dear SaaStr: Is It Normal to Feel Like a Pest When Prospecting for Customers For a Startup?

Dear SaaStr: Is It Normal to Feel Like a Pest When Prospecting for Customers For a Startup? Yes. Get better at it, get over it, and hire folks who know how to do it. Boy sales is hard. It’s being told No a lot. It’s having literal, or virtual, doors shut on your face. Sales…

Continue Reading

Popular Q&A

How To Reverse-Engineer a $100M Exit: SaaStr on My First Million Pod

How do you reverse-engineer your first million as a SaaS startup founder? SaaStr founder and CEO Jason Lemkin chats with Sam Parr on the popular YouTube channel and podcast My First Million about what’s required to make it on the map for a $100M exit and then reverse engineers the steps to get there.

Rule 1: New minimum is $400K per employee

Rule 2: Go multi-product

Rule 3: Your second product must be bigger than your first product

Cheat code: Double your prices

Rule 4: 30% of your revenue is international

Rule 5: Localize your product

Cheat code: Remove friction

Rule 6: 100% net revenue retention

Rule 7: Don’t raise double digit millions

Dear SaaStr: What Was the Toughest Rejection You Ever Had in Sales?

Dear SaaStr: What Was the Toughest Rejection You Ever Had in Sales? The hardest rejection I’ve had in sales was around renewals. Especially ones I thought we really had earned. But still lost. In particular, in the early days of EchoSign / Adobe Sign, we had a...

Why the Future of Customer Success, Sales and Marketing Has Changed For Good: Ask-Me-Anything Part 2 with SaaStr CEO and Founder Jason Lemkin

In part one of this week’s Ask-Me-Anything (AMA) with SaaStr founder and CEO Jason Lemkin, he answered the community’s questions about whether all anyone cares about is AI anymore, investor appetites going into 2024, vertical SaaS, and thriving as a solo founder....

Is AI the Only Thing in SaaS that Anyone Cares About Anymore? Ask-Me-Anything Part 1 with SaaStr CEO and Founder Jason Lemkin

In the first part of this open Ask-Me-Anything (AMA), Jason shares his thoughts on the current state of sales and marketing, if anyone really cares about anything other than AI anymore, how to hire great partners, and breaking out of a crowded ecosystem.

Doubling Down: Jay Levy Managing Partner at Zelkova Ventures

"Doubling Down" is a new series where we hear from top B2B SaaS investors on their most recent activities and takes on the current market. Kicking us off is Jay Levy, Managing Partner at Zelkova Ventures. #1. What’s your most recent disclosed investment? Why did you...

Dear SaaStr: Can an Entrepreneur Back Out of a Signed Term Sheet Without Damaging Their Reputation?

Dear SaaStr: Can an entrepreneur back out of a signed term sheet without damaging their reputation? In my experience — Yes, probably. As a founder, you can back out of a term sheet if something is off, or even if you just get another offer you prefer. There is a lot...