The Content You Need to Grow and Scale Your Company Faster

SaaStr Academy provides you with all of the knowledge and best practices you need in whatever format works the best for you!

The SaaStr Academy

SaaStr Academy provides you with all of the knowledge and best practices you need in whatever format works the best for you–whether you like blogs, podcasts, videos, ebooks, Q&A, or more!

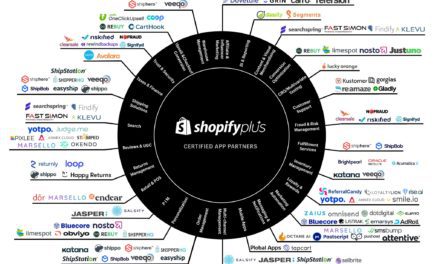

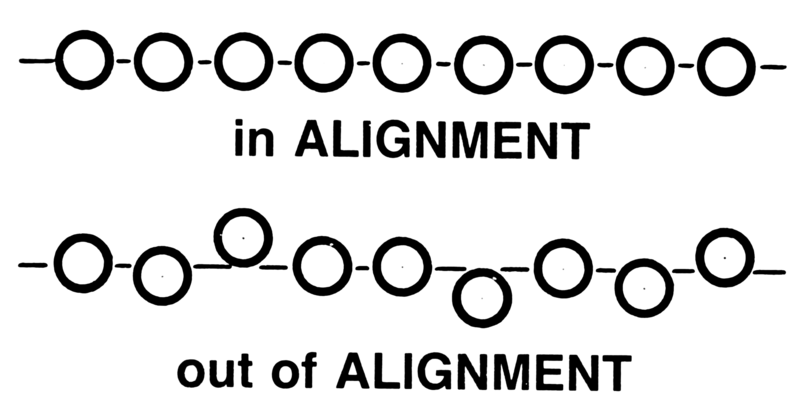

Our primary reason for existence and our biggest passion is our community. And our community is fueled by our content. Now you can have all of the great SaaStr content you love in one place–easily sortable by content type, company stage, role, and topic!

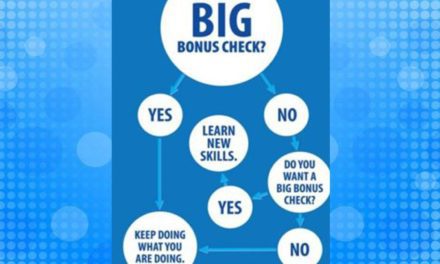

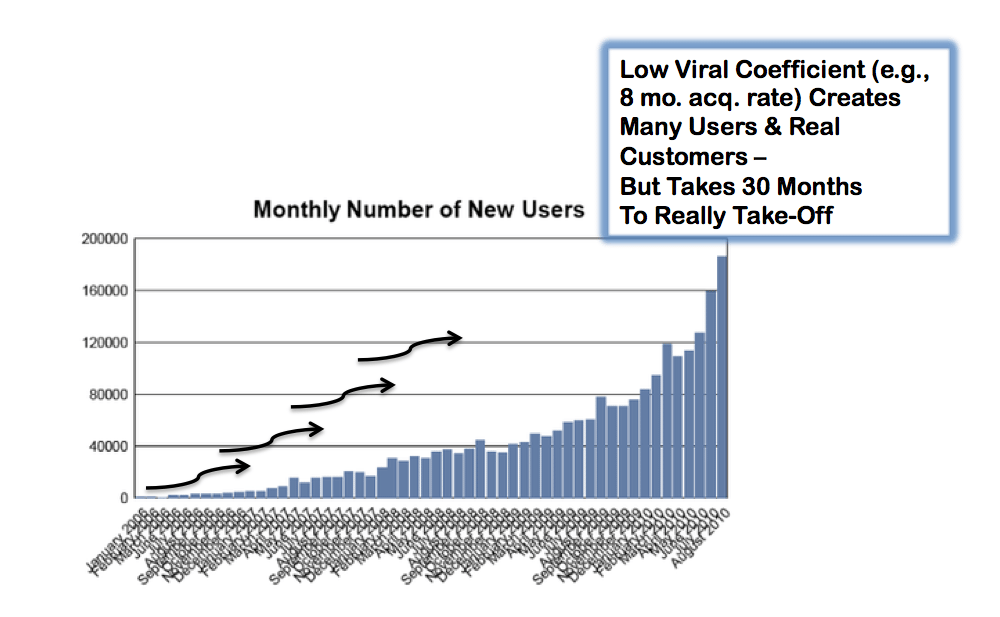

300+ Lessons In How To Scale Faster

Search / Ask a Question

Best of Sales

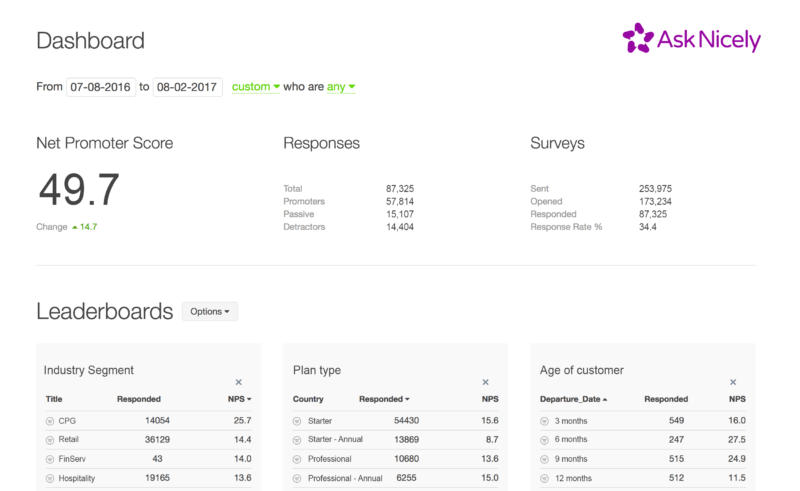

Best of Customer Success

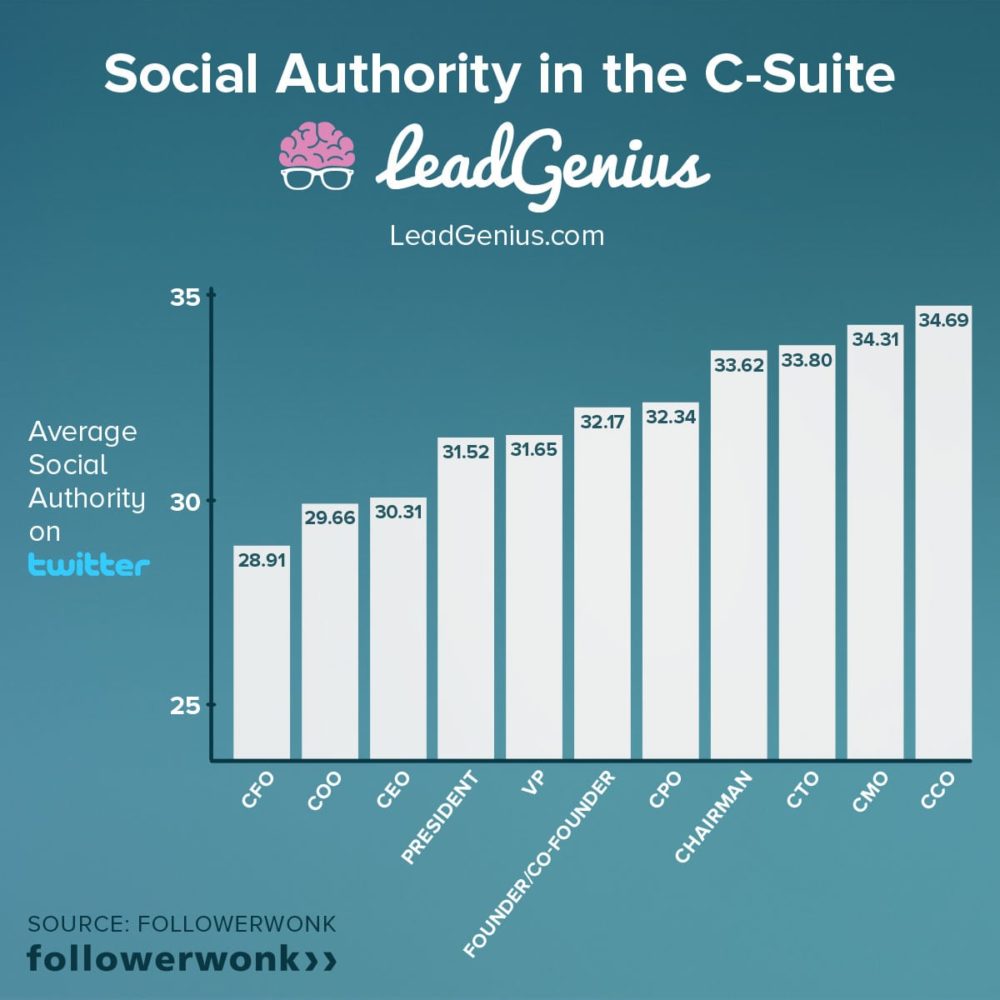

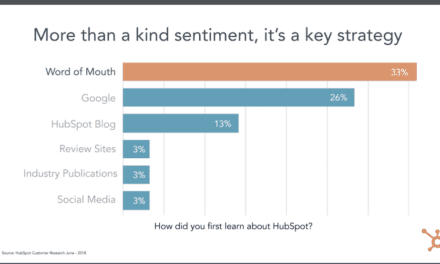

Best of Marketing

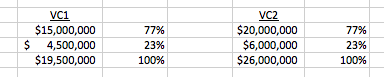

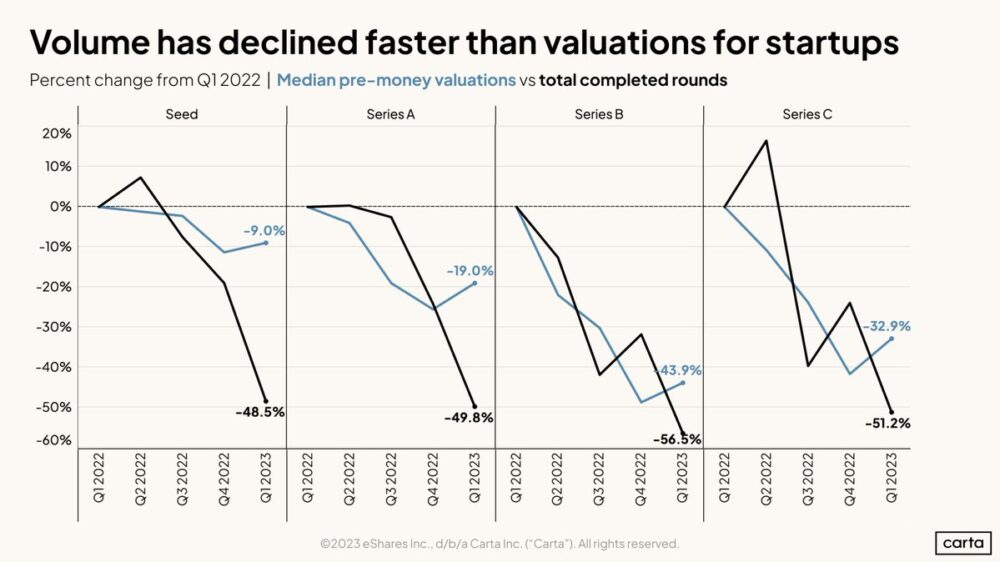

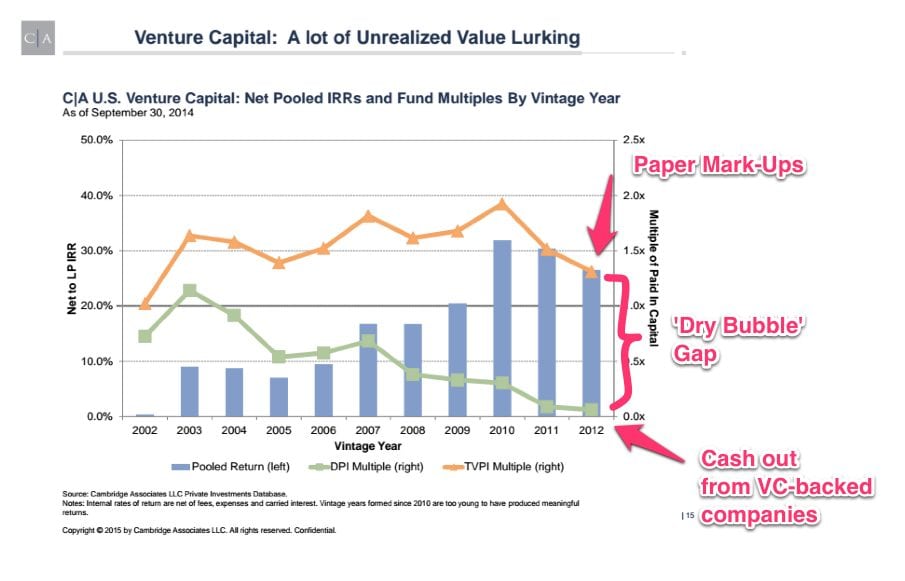

Best of Fundraising & Venture Capital

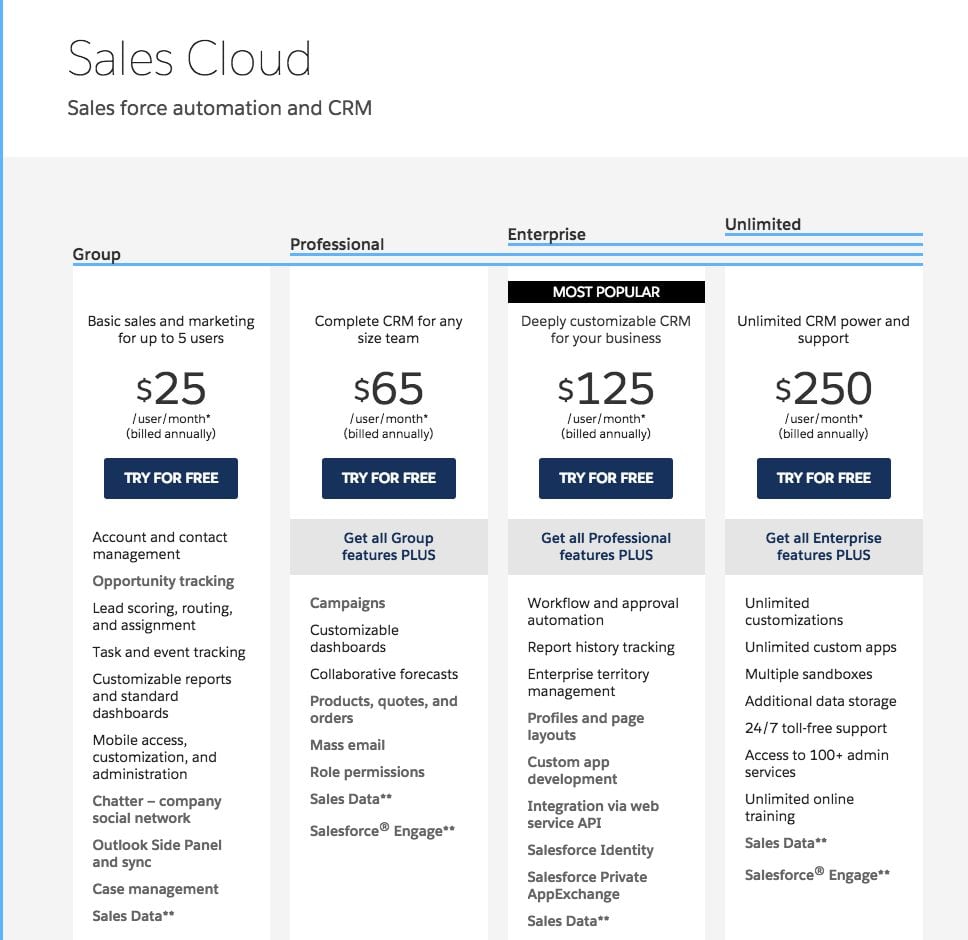

Best of Product & Pricing

Best of Growth & Scaling

Best of Answers

Best of Podcasts

Best of Videos

FREE eBooks!

Popular Q&A

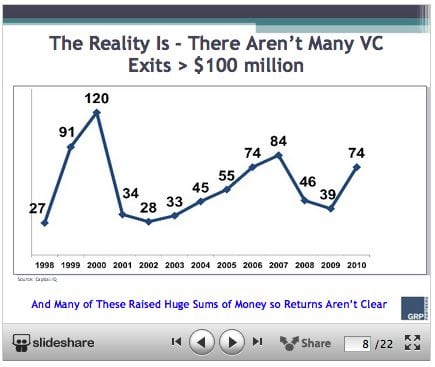

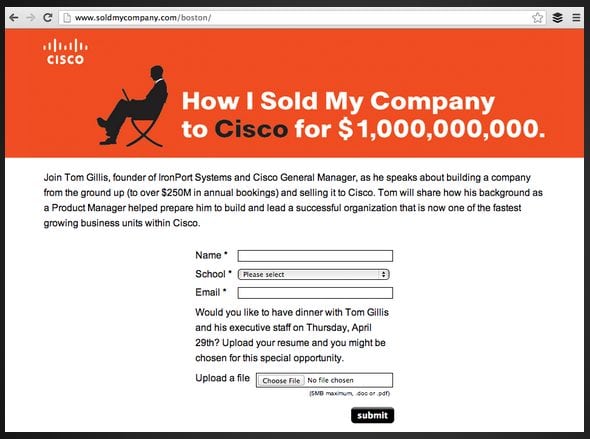

How To Reverse-Engineer a $100M Exit: SaaStr on My First Million Pod

Apr 19, 2024

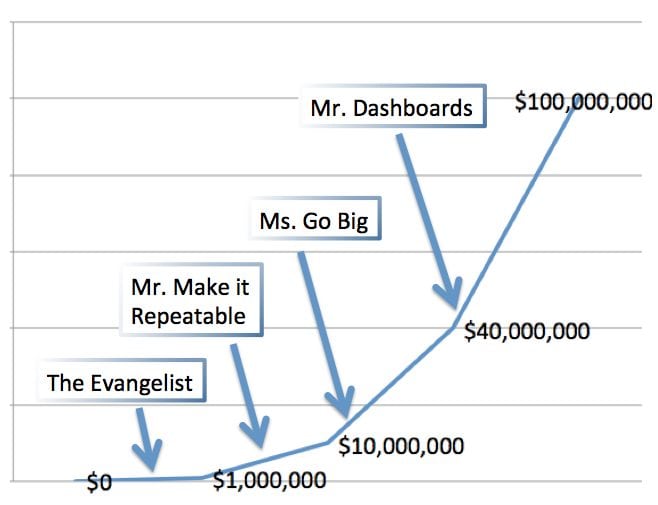

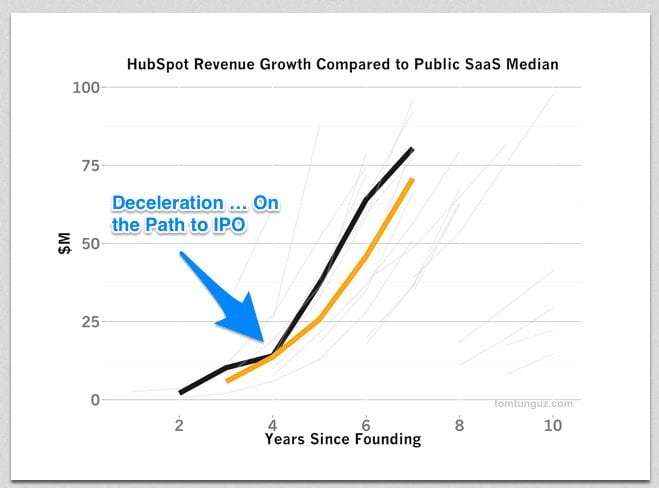

How do you reverse-engineer your first million as a SaaS startup founder? SaaStr founder and CEO Jason Lemkin chats with Sam Parr on the popular YouTube channel and podcast My First Million about what’s required to make it on the map for a $100M exit and then reverse engineers the steps to get there.

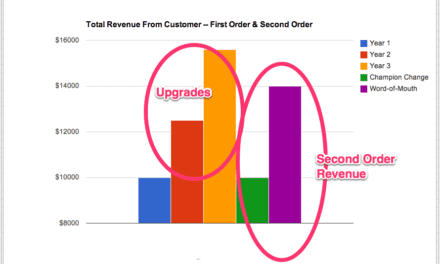

Rule 1: New minimum is $400K per employee

Rule 2: Go multi-product

Rule 3: Your second product must be bigger than your first product

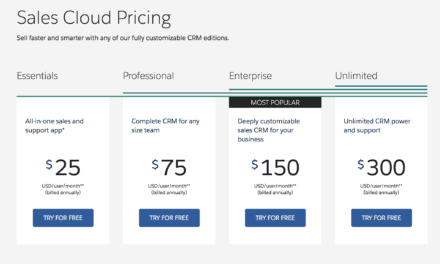

Cheat code: Double your prices

Rule 4: 30% of your revenue is international

Rule 5: Localize your product

Cheat code: Remove friction

Rule 6: 100% net revenue retention

Rule 7: Don’t raise double digit millions

Dear SaaStr: What Was the Toughest Rejection You Ever Had in Sales?

Feb 20, 2024

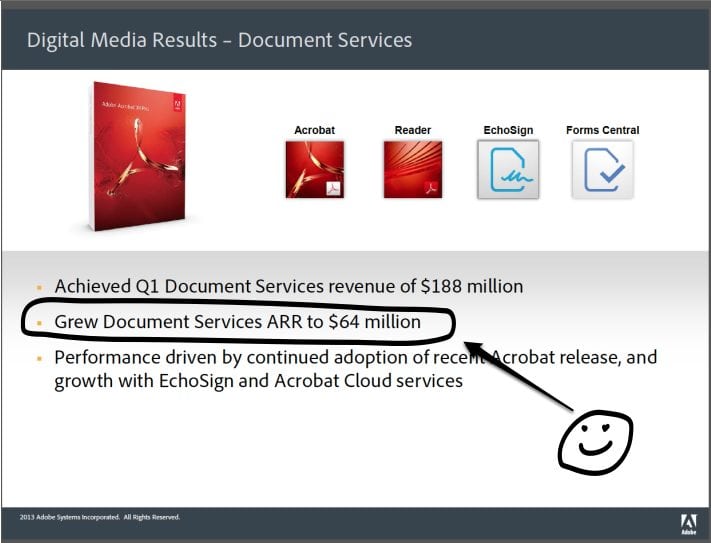

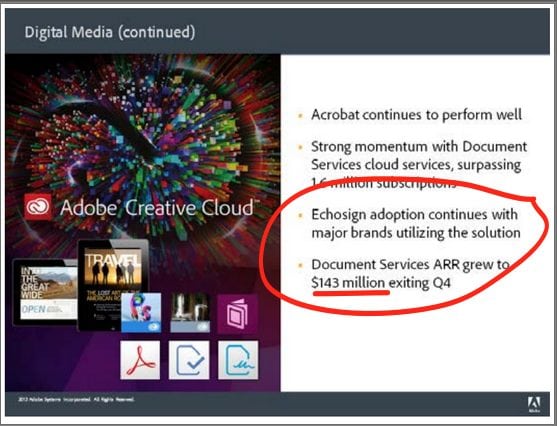

Dear SaaStr: What Was the Toughest Rejection You Ever Had in Sales? The hardest rejection I’ve had in sales was around renewals. Especially ones I thought we really had earned. But still lost. In particular, in the early days of EchoSign / Adobe Sign, we had a...

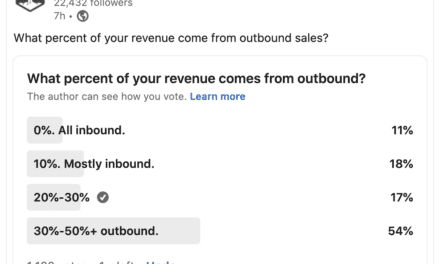

Why the Future of Customer Success, Sales and Marketing Has Changed For Good: Ask-Me-Anything Part 2 with SaaStr CEO and Founder Jason Lemkin

Dec 29, 2023

In part one of this week’s Ask-Me-Anything (AMA) with SaaStr founder and CEO Jason Lemkin, he answered the community’s questions about whether all anyone cares about is AI anymore, investor appetites going into 2024, vertical SaaS, and thriving as a solo founder....

Is AI the Only Thing in SaaS that Anyone Cares About Anymore? Ask-Me-Anything Part 1 with SaaStr CEO and Founder Jason Lemkin

Dec 28, 2023

In the first part of this open Ask-Me-Anything (AMA), Jason shares his thoughts on the current state of sales and marketing, if anyone really cares about anything other than AI anymore, how to hire great partners, and breaking out of a crowded ecosystem.

Doubling Down: Jay Levy Managing Partner at Zelkova Ventures

Dec 7, 2023

"Doubling Down" is a new series where we hear from top B2B SaaS investors on their most recent activities and takes on the current market. Kicking us off is Jay Levy, Managing Partner at Zelkova Ventures. #1. What’s your most recent disclosed investment? Why did you...

Dear SaaStr: Can an Entrepreneur Back Out of a Signed Term Sheet Without Damaging Their Reputation?

Aug 4, 2023

Dear SaaStr: Can an entrepreneur back out of a signed term sheet without damaging their reputation? In my experience — Yes, probably. As a founder, you can back out of a term sheet if something is off, or even if you just get another offer you prefer. There is a lot...